California’s debate over redefining and potentially taxing corporate control has rattled Silicon Valley, prompting tech founders like Google co-founder Larry Page to distance themselves from the state and leaving a once-confident tech empire facing deep anxiety over its future.

California’s technology sector is facing renewed turbulence as reports circulate that some of Silicon Valley’s most influential figures, including Google co-founder Larry Page, are spending less time in the state or restructuring their personal and corporate ties amid growing concern over proposed tax and governance changes.

What began as a technical policy debate in Sacramento has quickly evolved into a broader argument about control, ownership, and whether California’s regulatory reach is pushing its innovators to look elsewhere.

At the center of the controversy is a set of ideas discussed by policy analysts and lawmakers aimed at reassessing how corporate power is taxed and regulated, particularly in companies where founders retain disproportionate voting rights through dual-class share structures.

These arrangements, common in major tech firms, allow founders to maintain control long after their ownership stake declines.

Critics argue the system concentrates power without sufficient public accountability.

Supporters say it protects innovation from short-term political and market pressure.

While no law explicitly “taxing voting power” has been enacted, the mere discussion of treating control as a measurable economic asset has unsettled the tech world.

Investors and founders warn that redefining governance rights as taxable value could create legal uncertainty and discourage long-term investment.

“Once you start assigning a tax value to control, you are no longer just taxing wealth,” said one venture capital executive familiar with the debate.

“You are taxing decision-making itself.”

Larry Page, who stepped down as Alphabet’s CEO in 2019 but remains a key shareholder, has not publicly commented on his personal tax or residency decisions.

However, filings and industry chatter indicate that Page and other high-profile tech leaders have increasingly diversified their presence across states such as Florida, Texas, and Washington, all of which offer more predictable tax environments and fewer governance experiments.

Tech lawyers say this trend is less about a single policy and more about cumulative risk.

“Founders are extremely sensitive to uncertainty,” one attorney explained.

“They can plan around high taxes.

They struggle with unclear rules.”

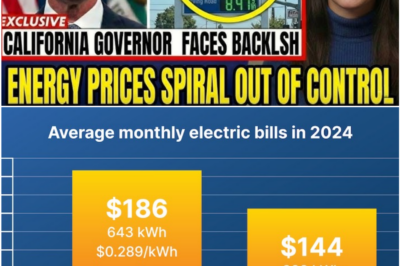

The timing is significant.

California is confronting budget pressures, debates over wealth taxation, and political pressure to address inequality created during decades of tech-driven growth.

Lawmakers defending the proposals insist they are not targeting individuals but modernizing a tax system they say has failed to keep pace with new forms of economic power.

“The economy has changed,” one Democratic lawmaker said during a recent policy forum.

“Our tax code hasn’t.”

Business groups reacted sharply.

Several tech associations warned that even floating the idea of taxing control rights could accelerate an exodus that has already seen companies shift headquarters, data centers, and manufacturing operations out of the state.

“Capital moves faster than legislation,” said a Silicon Valley founder who recently relocated part of his operations.

“Once trust is gone, it doesn’t come back easily.”

The debate has quickly spilled beyond California.

National commentators framed the issue as a test case for how far states can go in redefining wealth and power in the digital age.

Supporters see it as a long-overdue correction to unchecked corporate influence.

Critics call it a dangerous precedent that could undermine the structures that made American tech globally dominant.

For now, California officials stress that no final decisions have been made and that any changes would undergo extensive legal review.

But the reaction itself may already be shaping outcomes.

Real estate data shows continued interest from tech executives in low-tax states, and recruiters report that startup founders increasingly ask about regulatory stability before committing to California-based growth.

Whether the state ultimately acts or retreats, the message sent to Silicon Valley has been unmistakable.

As one longtime investor put it, “This isn’t about one founder leaving.

It’s about whether California wants to be the place where control is built — or the place where it’s questioned.”

News

PepsiCo Pulls the Plug on a California Frito-Lay Plant, Triggering Layoffs, Political Shockwaves, and a Regulatory Firestorm

PepsiCo’s shutdown of a California Frito-Lay plant, driven by rising regulatory costs and uncertainty, has left hundreds jobless and ignited…

California on the Brink While Davos Turns Cold: Newsom’s Overseas Snub Collides With Rising Unrest at Home

Governor Gavin Newsom’s embarrassing snub at Davos and explosive remarks abroad collided with escalating protests, looming federal intervention, and a…

California Energy Crisis Deepens: Historic Almond Plant Closes Amid Skyrocketing Costs

Blue Diamond Growers’ historic Sacramento plant shuts down due to skyrocketing energy costs, wildfire mitigation fees, and operational pressures, costing…

Robert’s Leadership Style Under the Microscope: What Startups Really Think

Startup founders describe Robert as a demanding yet transformative mentor whose hands-on, high-pressure leadership drives innovation and growth, pushes teams…

California Retail Meltdown: Walmart, Target, and Other Giants Close Stores Amid Rising Costs and Crime

Major retailers like Walmart, Target, and Macy’s are closing California stores due to rising labor costs, regulatory burdens, and surging…

Daymond John Under the Spotlight: Does the “Shark Tank” Icon Really Favor Fashion Startups?

Daymond John’s deep expertise and personal history in fashion give apparel startups a strategic edge on Shark Tank, as his…

End of content

No more pages to load