As pet owners, the well-being of our furry friends is a top priority, often leading us to explore every possible avenue to ensure their health and happiness. In recent years, innovations in artificial intelligence (AI) have started to influence a range of sectors — including healthcare, education, and even personal life coaching. But how might AI impact decisions around pet health insurance, a topic that resonates deeply with pet lovers who strive to provide the best care? Let’s explore the intersection of AI, pet wellness, and health insurance choices.

The Emergence of AI in Personal Decision-Making

Major tech companies like Google are pushing boundaries, developing AI systems capable of more than just routine or educational tasks. For instance, Google’s DeepMind project aims to create an AI life coach that can provide personalized advice and guidance on various aspects of life, from planning to tutoring. Such AI learns continuously from user interactions, becoming smarter and more adept over time.

This evolution means AI could soon become integral in advising us on complex decisions — possibly including financial and health-related choices for our pets. However, this raises important questions about accountability and trustworthiness. If an AI recommends a course of action that harms your pet or leads to financial strain, who is responsible? The developers? The users? These uncertainties highlight the infancy of AI applications and the need for careful consideration as AI becomes more involved in personal domains.

Understanding Pet Health Insurance Decisions

Many pet owners face difficult questions about whether to invest in pet health insurance. According to a Consumer Reports survey, about 78% of pet owners say they would be willing to go into debt to cover veterinary care if necessary. This willingness is especially pronounced among younger generations, with over half of millennials open to running up credit card debt for their pets.

Pet insurance policies vary widely in cost, typically ranging from $15 to over $50 per month. Factors influencing premiums include the pet’s species (cats generally cost less to insure than dogs), breed size, age, and any pre-existing health conditions. Like human health insurance, pet plans often include deductibles and exclude coverage for pre-existing conditions.

A real-life example underscores these challenges: A family adopting an 80-pound dog named Teddy discovered that his frequent ear infections were classified as a pre-existing condition and thus not covered by insurance. Despite paying $35 per month for coverage, they faced out-of-pocket expenses for early vet visits. Consequently, they opted to drop the insurance and set aside funds independently to cover Teddy’s regular care.

How AI Could Influence Pet Wellness and Insurance Choices

AI has the potential to revolutionize pet wellness by providing personalized recommendations based on a pet’s unique health profile, lifestyle, and even genetic factors. For instance:

Tailored insurance plans: AI could analyze veterinary records, breed risks, and lifestyle factors to suggest insurance plans best suited to individual pets, potentially optimizing coverage and cost-effectiveness.

Early health risk detection: AI-powered tools might predict future health issues, guiding owners toward preventive measures or insurance policies that cover likely conditions.

Financial planning assistance: Combining life coaching capabilities, AI could help pet owners weigh the costs and benefits of insurance vs. self-funding vet expenses, supporting smarter spending decisions aligned with personal budgets.

However, trust in AI’s recommendations must be balanced with awareness of its limitations. AI relies on data, and incomplete or biased information could lead to suboptimal advice. Moreover, ethical and legal frameworks for AI accountability in health decisions—whether for humans or pets—remain underdeveloped.

Navigating Pet Care in an AI-Enhanced Future

As AI becomes a more common tool for managing our personal and pet-related decisions, pet owners should approach these new technologies with curiosity and caution. Some practical steps include:

Research thoroughly: Understand the terms, exclusions, and costs of pet insurance plans. Don’t rely solely on AI or automated recommendations; consult with veterinary professionals as well.

Use AI as a guide, not a crutch: Treat AI suggestions as one input among many. Maintain critical thinking, especially when financial or health risks are involved.

Stay informed about AI advancements: As capabilities evolve, keeping abreast of new tools can empower you to make better-informed decisions for your pets’ health and finances.

Advocate for clear policies: Support calls for ethical guidelines and legal standards governing AI use in health advice, ensuring responsible applications protect pet owners and their beloved companions.

Conclusion

The bond between pet owners and their animals drives a profound commitment to wellness that sometimes involves complex decision-making about health insurance and care. AI offers exciting possibilities to enhance this process by delivering personalized, data-driven advice. Yet, this technology is still maturing and must be integrated cautiously, with clear awareness of its current limits and potential risks.

By combining human empathy, veterinary expertise, and intelligent AI tools, we can forge a future where pet wellness is supported by smarter decisions — ultimately helping our furry friends enjoy long, healthy, and happy lives.

News

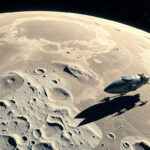

Unraveling Lunar Mysteries: What Scientists Reveal About Moon Phenomena in LRO’s 4K Exploration

The Moon has fascinated humanity for millennia, its silvery glow lighting our night skies and its rugged surface visible even…

Unveiling Brigitte Macron: The Untold Story Behind the Trogneux Controversy

In recent months, an extraordinary rumor surrounding Brigitte Macron, the French First Lady, has captured public attention and ignited heated…

Unveiling MK-Ultra: The Dark Secrets of CIA’s Cold War Mind Control Experiments

During the early years of the Cold War, a clandestine and deeply disturbing program was launched by the Central Intelligence…

Exploring America’s Hidden Gems: The 10 Most Isolated Outposts You Probably Haven’t Heard Of

When you think of military bases, bustling with activity near cities or hotspots of conflict likely comes to mind. However,…

Exploring the Enigma of Grays: Unpacking the Popularity of Alien Abductions and UFO Sightings with Josef Lorenzo

When most people envision an alien, the image that instantly springs to mind is often that of the iconic “Gray”…

Navigating the Cosmos: Unveiling the StarGrazer – The Next Generation High-Speed Interstellar Interceptor

In October 2017, the astronomy community witnessed an unprecedented event: the detection of the first known interstellar object passing through…

End of content

No more pages to load