The Hidden Cost of Inheritance: Kevin O’Leary Exposes a Tax Trap

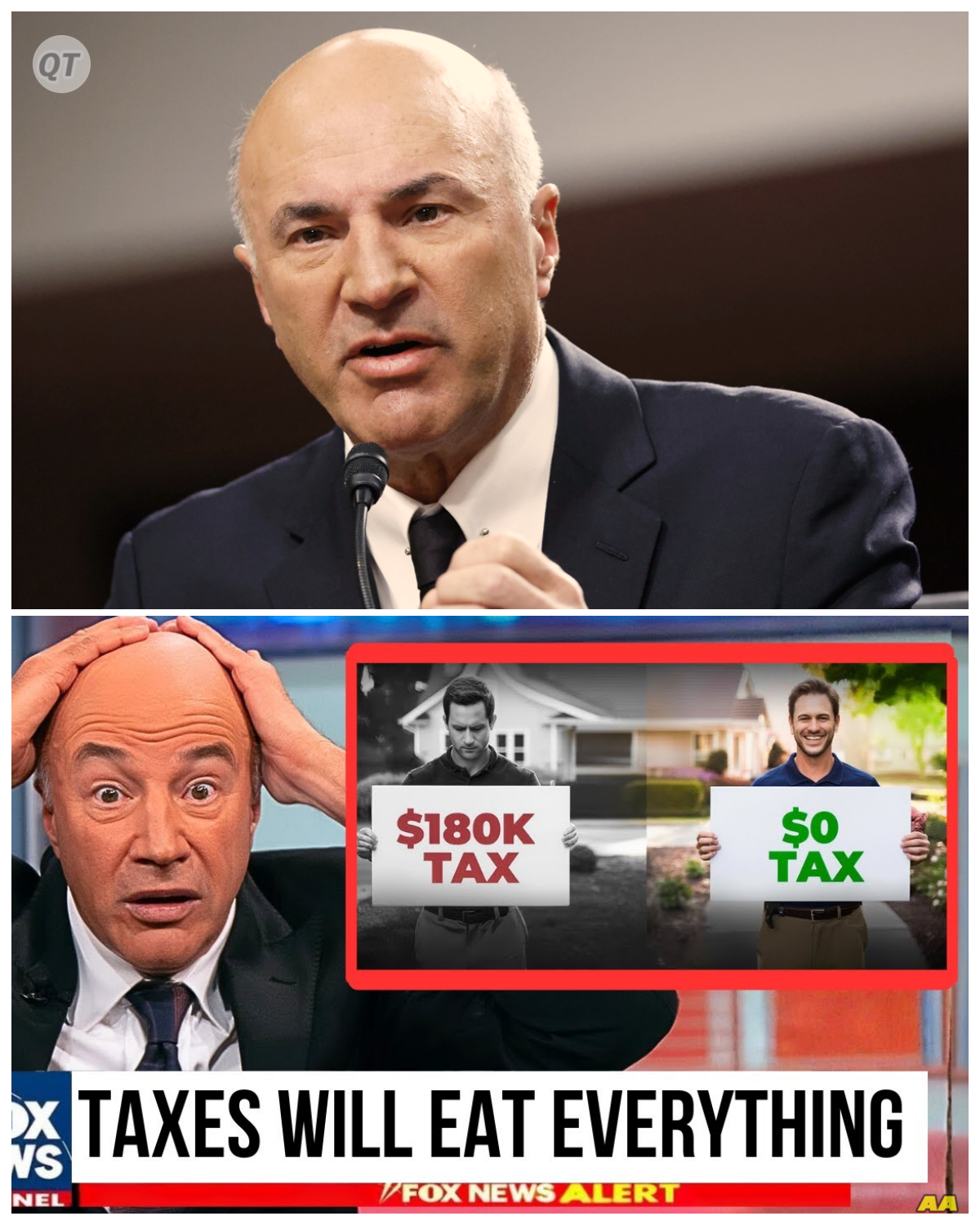

In a revelation that has sent shockwaves through the world of personal finance, Kevin O’Leary, the renowned entrepreneur and television personality, has unveiled a massive tax mistake that could devastate families planning to pass their homes to their children.

As the complexities of wealth transfer become increasingly apparent, O’Leary urges homeowners to reconsider their strategies, exposing a hidden cost that could turn the act of inheritance into a financial nightmare.

The emotional weight of this revelation is staggering.

For many, the family home represents not just a place to live, but a legacy, a symbol of hard work and sacrifice.

Yet, as O’Leary articulates, the reality of passing down property can come with a hefty price tag, one that could undermine the very intentions of parents seeking to provide for their children.

In a powerful moment, O’Leary lays bare the harsh truths of estate planning, revealing the shocking statistics around taxes that families face when transferring property.

He emphasizes that without proper planning, heirs can find themselves burdened with unexpected tax liabilities that can strip away the value of the inheritance, leaving them with little more than a hollow shell of what was once a cherished family home.

As we delve deeper into O’Leary’s insights, we uncover the psychological implications of this financial trap.

The thought of leaving a legacy should bring comfort and peace of mind, yet the fear of financial loss looms large, casting a dark shadow over family dynamics.

What should be a moment of joy and celebration can quickly turn into a source of anxiety and conflict, as families grapple with the realities of taxes and legal obligations.

The question arises: how did we arrive at this point where passing down a home could lead to financial ruin?

O’Leary points to the complex web of tax laws and regulations that govern inheritance, exposing a system that often seems designed to penalize rather than reward.

As families navigate this labyrinth, the emotional toll can be significant, leading to feelings of frustration and helplessness.

In a world where wealth is often equated with security, O’Leary shines a light on the vulnerabilities that come with it.

The psychological burden of ensuring that one’s children are taken care of can become overwhelming, especially when faced with the prospect of losing a significant portion of that inheritance to taxes.

As O’Leary shares stories of families who have fallen victim to this trap, the urgency for action becomes clear.

He advocates for proactive measures, urging homeowners to consider revocable living trusts and other strategies that can mitigate tax liabilities and protect their loved ones from financial distress.

In this cinematic tale of ambition and despair, the investigation reveals the stark contrasts between the intentions of parents and the realities imposed by the system.

The fallout from these revelations is not just a personal crisis; it is a reflection of the broader struggles faced by many families in today’s economic landscape.

As O’Leary battles against the tides of misinformation, the need for education and awareness becomes paramount.

The time for change is now, as he calls on families to take control of their financial futures and make informed decisions that will safeguard their legacies.

In the end, this story serves as a powerful reminder of the fragility of wealth and the complexities of inheritance.

As Kevin O’Leary navigates this tumultuous landscape, he is not just fighting for financial literacy; he is fighting for families who deserve to pass down their legacies without fear of financial ruin.

As we watch this drama unfold, one thing is certain: O’Leary’s revelations are a wake-up call for all of us.

The need for transparency and proactive planning has never been more urgent, as we confront the realities of wealth transfer in a system that often feels stacked against us.

Will families rise to the occasion and embrace the necessary changes, or will they continue to fall prey to the hidden costs of inheritance?

The answers lie ahead, and the world watches closely as this story continues to develop.

As we reflect on the implications of O’Leary’s message, we are reminded that behind every financial decision lies a human story filled with hopes, dreams, and the desire to protect those we love.

The clock is ticking, and the future of family legacies hangs in the balance.

In a world where financial literacy is crucial, Kevin O’Leary stands as a beacon of hope, advocating for families to understand the stakes and make informed choices that will secure their legacies for generations to come.

In the end, it is not just about the numbers; it is about the love and intention behind every decision made, and the enduring impact those decisions will have on future generations.

News

🐘 “California’s New Tax Shocks Billionaires: Tax Attorney Reveals Their Reactions!” 🔥 In a dramatic turn of events, a tax attorney has revealed the reactions of billionaires to California’s recent tax changes. “What did they say behind closed doors?” As their candid comments are exposed, the fallout from this tax policy could have significant repercussions for the state’s wealthiest individuals and beyond! 👇

The Great California Exodus: Billionaires Flee as Wealth Tax Looms In a dramatic turn of events that has sent shockwaves…

🐘 “Katt Williams Unveils the Truth: What Really Happened to Martin Lawrence?” 🔥 In a sensational disclosure, Katt Williams has opened up about the hidden aspects of Martin Lawrence’s life and career, shocking fans and the comedy community alike. “Could this change our perception of Martin forever?” As Katt lays bare the truth, the repercussions of his revelations are sure to send shockwaves through the entertainment world! 👇

Katt Williams Unveils the Dark Truth Behind Martin Lawrence’s Struggles In a shocking revelation that has sent ripples through the…

🐘 “Edwin Schlossberg: The Man Behind Tatiana — Family, Career, and Legacy Explored!” 📚 Dive into the world of Edwin Schlossberg, Tatiana Schlossberg’s father, and discover his remarkable journey through art, design, and family life. “What is the essence of his legacy?” With a career marked by creativity and a deep commitment to his family, Edwin’s story is one of inspiration and influence that continues to shape the future! 👇

Edwin Schlossberg: The Man Behind the Kennedy Legacy and His Untold Story In the shadows of the Kennedy dynasty, where…

🐘 “Meghan’s Bold Move: Harry’s Inheritance FROZEN as William Speaks on Diana’s Prophecy!” 🚨 In an unprecedented move, Meghan has reportedly frozen Harry’s inheritance, stirring controversy and intrigue within the royal family. “Could this be the realization of Princess Diana’s chilling prophecy?” As William steps forward to validate his mother’s foresight, the implications for the Sussexes and the monarchy are profound, leaving the public eager for more details! 👇

Frozen Legacy: Meghan’s Shocking Move and the Prophecy of Princess Diana In a shocking twist that has sent tremors through…

🐘 “Rob Reiner’s Son Jake EXPOSED: Shocking Revelations After Tragic Events!” 😱 In a stunning twist, Jake Reiner, son of the famed director Rob Reiner, has been thrust into the spotlight following a series of tragic events. “What really happened behind the scenes?” As shocking details emerge, the public is left in disbelief, and the fallout from this revelation could change everything for the Reiner family! 👇

The Shocking Truth Behind Jake Reiner’s Fall from Grace: A Hollywood Exposé In a stunning turn of events that has…

🐘 “California Governor RAGES After Boeing’s Plant Shutdown Announcement!” ⚡ In a furious outburst, the Governor of California has reacted to Boeing’s decision to shut down its plant, igniting fears of widespread job losses and economic decline. “What will this mean for our workers?” As the community braces for the fallout, the repercussions of this shutdown could have lasting effects on the state’s industrial landscape! 👇

Boeing’s Betrayal: The Shocking Fallout of California’s Economic Collapse In a stunning turn of events that has left California reeling,…

End of content

No more pages to load