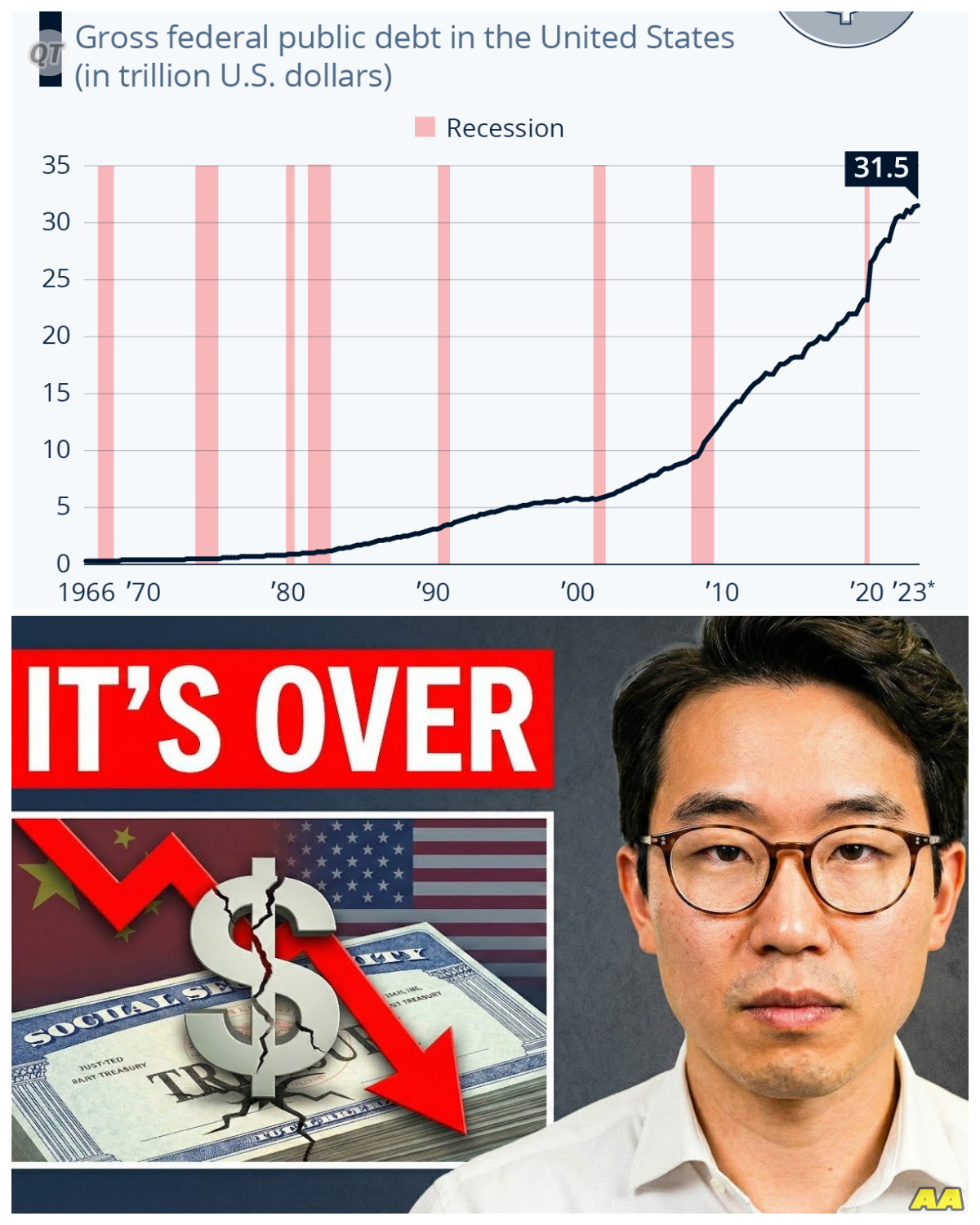

The Financial Apocalypse: China’s Shocking Move to Sell All U.S.Debt

In a world where economic stability often feels like a carefully constructed facade, the recent news of China pulling the trigger on a staggering $850 billion sell-off of U.S.debt sends tremors through the financial landscape.

This bold maneuver is not just a financial transaction; it is a declaration of war on the very foundations of the American economy.

The implications are profound, and the consequences are poised to ripple through every household, affecting everything from mortgage rates to the value of the dollar itself.

As the news broke, the metaphor of a ticking time bomb comes to mind.

The bond market, which has long been the backbone of low U.S.interest rates, is now facing an unprecedented crisis.

China’s decision to divest from U.S.debt is akin to a nuclear option in financial warfare, a strategic move that threatens to destabilize the entire system that has kept America afloat for decades.

The ramifications of this sell-off are not just theoretical; they are a stark reality that is beginning to unfold before our eyes.

The immediate effects of China’s actions are already being felt across the financial spectrum.

Mortgage rates, once tethered to the Federal Reserve’s policies, are now breaking free from their constraints.

The metaphor of a runaway train illustrates this scenario perfectly; as the bond market loses buyers, interest rates are set to climb, leaving ordinary Americans grappling with the rising costs of living.

The era of cheap money that propped up the American economy is rapidly coming to an end, and the average citizen is left to bear the brunt of this seismic shift.

As the dust settles from this financial earthquake, analysts and economists scramble to make sense of the chaos.

The layers of complexity surrounding this situation are staggering.

The hidden debt that few are discussing adds another dimension to the crisis.

The metaphor of an iceberg lurking beneath the surface captures this reality; while the visible sell-off is alarming, there are deeper issues at play that threaten to sink the entire ship of state.

China’s decision to walk away from U.S.debt is a calculated move that sends a clear message: the balance of power is shifting.

The implications of this shift are profound, raising fundamental questions about the future of the dollar and the global economy.

The metaphor of a chess game, where each move is strategic and calculated, resonates here; China has made a bold play, and the world is left to wonder how the United States will respond.

The financial landscape is changing, and the traditional 60/40 portfolio—once considered a safe haven for investors—is now officially dead.

The rules of the game have changed, and those who cling to old strategies may find themselves left in the dust.

The metaphor of a phoenix rising from the ashes offers a glimmer of hope; while this moment marks the end of an era, it also presents an opportunity for innovation and adaptation in the face of adversity.

As the bond market adjusts to this new reality, the implications for everyday Americans are dire.

The cost of living is set to rise, and financial security is becoming increasingly elusive.

The metaphor of a tightening noose captures this sentiment; as interest rates climb and the dollar loses its strength, families across the nation will feel the pressure.

The reality of financial instability is no longer abstract; it is a tangible threat that looms over every household.

In this climate of uncertainty, the question arises: where will smart money run when bonds and cash die? Investors are left scrambling for safe havens, seeking refuge from the impending storm.

The metaphor of a ship seeking harbor in a tempest resonates here; as the financial world braces for impact, the search for stability becomes paramount.

The choices made in the coming months will shape the future of the economy and determine who emerges unscathed from this financial apocalypse.

As the narrative unfolds, the role of the media cannot be overlooked.

The sensationalism surrounding China’s actions fuels public anxiety and shapes perceptions of the crisis.

The metaphor of a wildfire spreading through dry brush captures this dynamic; the media frenzy amplifies fears and drives home the urgency of the situation.

1.png)

The public is left to navigate a landscape filled with conflicting information and dire predictions, heightening the sense of panic and uncertainty.

In the midst of this chaos, the psychological toll on individuals and families is profound.

The metaphor of a dark cloud hanging over society illustrates the pervasive anxiety that accompanies financial instability.

As people grapple with the reality of rising costs and dwindling savings, the emotional burden becomes heavy.

The stress of uncertainty weighs on the minds of many, leading to a collective sense of despair that permeates the fabric of society.

In conclusion, China’s decision to sell all U.S.debt marks a pivotal moment in financial history, one that signals the end of an era characterized by low interest rates and economic stability.

The implications of this sell-off are far-reaching, affecting not only the bond market but also the lives of everyday Americans.

As the dust begins to settle, the reality of financial warfare becomes clear, and the world watches closely to see how the United States will respond to this unprecedented challenge.

The story is far from over, and as the financial landscape shifts beneath our feet, the consequences of this decision will resonate for years to come.

The stage is set for a new chapter in economic history, one that demands resilience, adaptability, and a willingness to confront the harsh realities of a changing world.

News

🐶 GAVIN NEWSOM: THE AMBITIOUS LEADER or CALIFORNIA’S MOST CORRUPT? — The EXPLOSIVE Price of Power EXPOSED! In a stunning turn of events, the facade of California’s Governor Gavin Newsom is crumbling as shocking allegations of corruption come to light! As his ambitious quest for power unfolds, the true cost of his decisions raises eyebrows and questions about his integrity. What scandalous truths lie beneath the surface, and how will they impact his future? Get ready for the gripping revelations that will leave you questioning everything about California’s leadership! 👇

The Dark Ambition of Gavin Newsom In the heart of California, the sun shone brightly, casting a golden hue over…

🐘 “Courtroom Drama: He COLLAPSES as GUILTY Verdict Is Announced—What Happens Next?” 🌪️ In a jaw-dropping scene, he fell to the floor in shock as the jury delivered a guilty verdict on all counts, “In the pursuit of justice, sometimes the truth is too much to bear!” As the courtroom buzzes with disbelief, the implications of this verdict loom large. How will this moment shape the narrative moving forward, and what consequences await the convicted? 👇

A Fall from Grace: The Shocking Verdict that Shook a Nation In the grand theater of American justice, where the…

🐶 MTG LEFT REELING: BILL MAHER UNCOVERS NICK FUENTES CONNECTIONS — The SHOCKING LIVE TV MOMENT That Will GO DOWN IN HISTORY! In an unforgettable confrontation, Bill Maher exposed the hidden connections between Marjorie Taylor Greene and the controversial Nick Fuentes, leaving her at a loss for words! As the audience gasped, Maher’s bold revelations shattered her carefully constructed narrative, revealing the chaos that lies beneath her political facade. What explosive truths did he bring to light that could alter the course of her career? Get ready for the gripping details that will have everyone talking! 👇

The Silent Reckoning: When Truth Shatters Illusions In the dimly lit studio, the air crackled with tension. Bill Maher sat…

🐘 “Truth Unveiled: Blake Lively & Justin Baldoni’s Unsealed Evidence EXPOSES the Lies—What You Need to Know!” 🕵️ In a dramatic revelation that has rocked the celebrity world, unsealed evidence involving Blake Lively and Justin Baldoni has surfaced, “When the truth is finally revealed, the facade comes crashing down!” As the claims that once seemed solid begin to unravel, fans are eagerly awaiting the fallout. How will this impact the careers and public images of these stars moving forward? 👇

Unveiling the Truth: Blake Lively and Justin Baldoni’s Scandal Exposed In the dazzling world of Hollywood, where dreams are spun…

🐘 “Hollywood’s Heartbreak: Celebrities React to the Loss of Catherine O’Hara—Tributes from Pedro Pascal, Ron Howard & More!” 😢 As the news of Catherine O’Hara’s death spreads, the entertainment community is coming together to honor her legacy, with heartfelt messages from stars like Pedro Pascal and Ron Howard, “In the tapestry of Hollywood, her thread will never fade!” With each tribute, fans are reminded of O’Hara’s remarkable career and the indelible mark she left on the world of comedy. How will her influence continue to resonate? 👇

The Heartbreak of Hollywood: Catherine O’Hara’s Untimely Passing Shakes the Entertainment World In the glittering realm of Hollywood, where laughter…

🐶 LIVE TV BOMBSHELL: Ana Kasparian BLASTS Gavin Newsom — The EXPLOSIVE EXPOSE That Will ROCK California Politics! In a stunning live broadcast that felt like a scene from a political thriller, Ana Kasparian confronted Governor Newsom with hard-hitting truths that left the audience in stunned silence! With fearless candor, she dismantled his carefully crafted image, exposing the shocking realities that lie beneath the surface. What dark secrets did she reveal that could spell disaster for Newsom’s future? Prepare for the gripping drama that will have everyone buzzing! 👇

The Unraveling of a Political Illusion In a world where truth and deception dance a delicate waltz, Ana Kasparian stood…

End of content

No more pages to load