The local Somali community in Minnesota says it is now facing intense backlash as federal investigators deepen a sweeping fraud probe that has sent shockwaves through the Twin Cities. While community leaders urge caution against broad blame, the scale of what authorities say they have uncovered has transformed a once-technical compliance review into a national reckoning over oversight, accountability, and the vulnerability of public assistance programs.

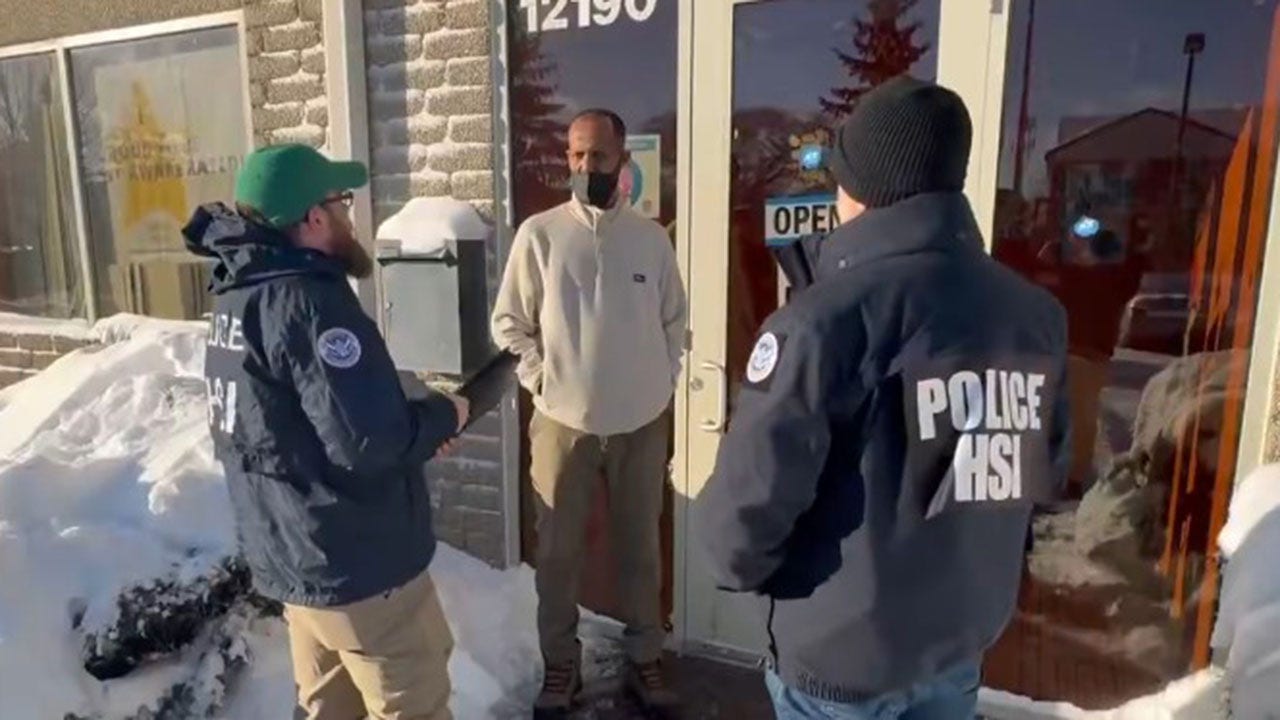

At 6:42 a.m. in Saint Paul, temperatures hovered well below freezing as three unmarked federal SUVs idled quietly along a residential street. Inside were eleven inspectors from the Federal Bureau of Investigation and the Department of Health and Human Services. Officially, their mission was simple: a routine compliance inspection of a state-licensed child care facility. There were no flashing lights, no tactical gear, and no expectation—at least on paper—of criminal activity.

The center was operated by Amina Farah Hassan, a 45-year-old director whose public record appeared spotless. According to licensing documents, she oversaw five separate child care centers across the Twin Cities, collectively serving more than 820 children per day. Those enrollment figures triggered substantial state and federal subsidies, which arrived like clockwork. Over four years, payments to the network surpassed $2.8 billion.

But the moment inspectors stepped inside the St. Paul facility, something felt wrong. The building was silent. No parents. No children. No staff. Toys sat neatly arranged on shelves, coated with a fine layer of dust. Cribs were assembled but untouched, their mattresses pristine. Attendance sheets hung on the wall, meticulously filled out in blue ink, every name checked, every day accounted for. Yet the space itself felt unused, frozen in time.

That single center had received more than $46 million in taxpayer funding in the previous twelve months alone. Investigators could find no evidence that a single child had ever spent a full day inside.

Inside the director’s office, inspectors discovered a heavy binder containing rosters for more than 700 children. As pages were turned, the scope of the deception became clear. The names were not random. Investigators allege the network created synthetic identities using real Social Security numbers purchased on the dark web, paired with forged birth certificates produced by a clandestine print operation. These “ghost children” existed only in government databases, generating a steady stream of payments intended to support families in need.

The investigation took a darker turn when a steel safe bolted to the floor was forced open. Inside were $38 million in shrink-wrapped cash and several sealed packages marked with the insignia of Jalisco New Generation Cartel. In that moment, inspectors realized they were no longer dealing with administrative fraud. According to federal authorities, the facility functioned as a laundering terminal for transnational criminal proceeds, funded entirely by U.S. taxpayer dollars.

As auditors widened their review, additional names surfaced, including Samira Abdi Hassan, listed as a co-director across multiple sites. Records showed duplicated addresses, overlapping birth dates, and enrollment figures that defied basic logic. From 2021 to 2025, reimbursements tied to the network reached $2.8 billion, with some monthly deposits exceeding $74 million. Less than four percent of those funds could be linked to legitimate expenses such as food, rent, or payroll.

Money moved quickly and quietly through 43 intermediary accounts, often in transfers deliberately kept below federal reporting thresholds. More than $312 million passed through a single account in under nine months without paying a single employee. Funds were traced to East Africa, the Middle East, and shell companies in Mexico, reinforcing federal concerns that the operation survived not by hiding, but by appearing ordinary.

Investigators allege the network went to extraordinary lengths to maintain that illusion. Digital files revealed “simulation shifts,” detailing schedules for paid actors who parked cars during drop-off hours. Outdoor speakers hidden in bushes played recorded sounds of children laughing on a loop. Used car seats were rotated between vehicles to mimic real families. It was a carefully choreographed performance designed to deceive inspectors conducting brief, procedural visits.

By late evening, prosecutors authorized a coordinated sweep. Five child care facilities and a dozen affiliated offices across Minneapolis were raided simultaneously. As agents moved in, financial alarms triggered. Nearly $96 million was rerouted in under twenty minutes, suggesting advance warning. Surveillance later showed Hassan leaving her residence hours earlier, her vehicle tracked heading south.

The pursuit led investigators to an industrial property roughly thirty miles outside the city. Though listed as abandoned, utility records told another story: massive electricity usage, extreme water consumption, and consistent nighttime activity. When agents breached the compound, they encountered industrial scrubbers, conveyor belts still running, and evidence of large-scale chemical processing.

Behind a secondary corridor, rescue teams found 61 individuals—some American citizens, others foreign nationals—many malnourished and reported missing months earlier. Investigators allege some had their fingerprints chemically burned off to prevent identification. The stolen child care funds, authorities say, had been used to purchase precursor chemicals, financing a closed-loop system that converted public assistance dollars into narcotics production.

By morning, the confirmed taxpayer loss exceeded $4.3 billion. Officials estimate more than 68,000 low-income children lost access to legitimate child care as fraud distorted the system. Licensed providers closed, unable to compete with operations that never paid for staff or food.

Community leaders now warn against stigmatization, noting that most Somali Minnesotans have no connection to the crimes. Yet the case has forced a hard national conversation about oversight, speed versus verification, and how compassion can be exploited at scale.

The investigation remains active. Assets are frozen. Arrest warrants are pending. And as Minnesota grapples with the fallout, one question lingers: how many other empty buildings are quietly collecting millions while the people they were meant to serve go without?

News

Mystery Deepens in Case of Slain Ohio Dentist and His Wife

The double homicide of Spencer Tepee and his wife Monnique Tepee has shaken Columbus, drawing national attention and leaving a…

FBI & ICE RAID Uncover Tunnel Under Somali Attorneys’ Minneapolis Mansion — 2.64 Tons, 96 Arrests

The past week has been marked by mounting tension across the Twin Cities as state and federal authorities carried out…

FBI & ICE Strike $23,000,000 Cartel Tunnel in Illinois — 600+ Arrests

This has been an extraordinarily tense situation for more than a week, as a widening federal investigation has led to…

FBI & ICE Take Down Malibu Lawyer — $23M Secret Cartel Tunnel Exposed

Before dawn, while entire neighborhoods remained dark and quiet, federal tactical teams moved simultaneously across multiple locations, transforming ordinary homes…

FBI & ICE STORM Minneapolis — Shooting UNLEASHES Cartel War & Somali Mayor FALLS

It began with one gunshot on a snow-covered street in Minneapolis, a moment that seemed, at first, like another flashpoint…

1 MIN AGO: FBI & ICE STORM Minneapolis — 5.5 Tons, $74 Million SEIZED & Judge EXPOSED

At 4:47 a.m., the historic stretch of Portland Avenue South in Minneapolis lay frozen and silent, its Victorian homes glowing…

End of content

No more pages to load