California’s Corporate Exodus: The Shocking Truth Behind Apple’s $57 Billion Tax Crisis

In a dramatic turn of events, California finds itself at the center of a corporate storm that could redefine the landscape of American business.

The state’s aggressive tax policies have triggered a seismic shift, with tech giant Apple threatening to relocate its headquarters from Cupertino to Texas.

This shocking revelation has sent ripples through Silicon Valley and beyond, raising questions about the future of corporate taxation in America.

Tim Cook, Apple’s CEO, stands at the helm of this crisis.

Faced with the potential imposition of a staggering $57 billion annual tax burden on Apple’s global revenue, Cook has made it clear that drastic measures are necessary.

The Global Revenue Assessment Act, designed to extract more from successful companies, has inadvertently put the very foundation of California’s economy at risk.

Cook’s threat to move the entire Cupertino headquarters is not just a corporate maneuver; it is a clarion call for businesses everywhere to reconsider their ties to California.

The implications of this tax assault are profound.

Apple’s decision to freeze hiring in California has left many employees in limbo.

Jennifer Park, an Apple engineer, found herself on the receiving end of this corporate freeze.

Her promotion, once a certainty, evaporated overnight as the company halted all recruitment efforts in the state.

The emotional toll on employees like Park is palpable, as dreams of advancement are dashed by the whims of state policy.

But the repercussions extend beyond the tech giant itself.

Small businesses that rely on Apple’s presence are feeling the heat.

Miguel Rodriguez, a local caterer, witnessed an 80% collapse in his business as Apple suspended operations.

The once-thriving catering service, which catered to Apple events, now struggles to survive.

Rodriguez’s story is a stark reminder of how interconnected the corporate ecosystem is, and how one decision at the top can have devastating effects on the ground.

The numbers tell a grim story.

In 2023 alone, Apple paid an astonishing $13.

2 billion in California taxes, surpassing the total revenue collected by over 40 states.

The proposed 15% global revenue tax could force Apple to make unimaginable sacrifices.

Dividends could be eliminated, stock buybacks halted, and a staggering 100,000 employees could face layoffs globally.

The very idea that the world’s most valuable company could operate at a loss due to punitive taxation is a narrative that sends shivers down the spine of investors and employees alike.

As the threat of relocation looms, the real estate market in Silicon Valley has already begun to feel the strain.

Reports indicate a 45% crash in property values following the announcement of Apple’s potential move.

Homeowners and investors are left grappling with the fallout of a corporate exodus that could reshape the region’s economic landscape.

The irony is thick; California’s attempt to generate revenue through aggressive taxation may ultimately lead to the loss of its largest taxpayer.

This situation is not merely about Apple; it represents a broader commentary on the relationship between government and business.

The ideological battle over taxation has reached a boiling point.

California’s leaders, in their quest to tax success, have inadvertently threatened the very source of their revenue.

The metaphorical goose that laid the golden egg is now in peril, and the consequences could be dire for the state.

As the dust settles, the question remains: what does the future hold for California’s corporate landscape? The potential relocation of Apple is a wake-up call for policymakers.

If businesses can relocate their headquarters for a one-time cost of $15 billion to save $57 billion annually, the math is undeniably simple.

Tim Cook and his team are not just considering a move; they are setting a precedent that could inspire other corporations to follow suit.

The stakes are high, and the emotional weight of this corporate saga cannot be overstated.

Employees like Jennifer Park and Miguel Rodriguez are not just statistics; they are real people facing real consequences.

Their stories highlight the human cost of political decisions and the fragile nature of economic stability.

As we watch this unfolding drama, one thing is clear: the relationship between corporations and government is at a crossroads.

California’s tax policies may have ignited a firestorm that could lead to a mass exodus of businesses seeking more favorable environments.

The narrative of corporate America is changing, and the consequences of this crisis will be felt for years to come.

In the end, this isn’t just about Apple or California.

It is a cautionary tale about the dangers of overreach and the importance of fostering a business-friendly environment.

The fallout from this crisis will reverberate throughout the nation, prompting discussions about the balance between taxation and economic growth.

As we stand on the precipice of this corporate exodus, one thing is certain: the landscape of American business will never be the same.

News

🚨 ICE & FBI STORM CHICAGO in a DAWN RAID — 5,000 Sinaloa Suspects Rounded Up as 8,818 Pounds of Fentanyl Linked to CJNG CARTEL Vanish from the Streets 💥🧨 Sirens, flashbangs, and sealed doors marked a takedown insiders call months in the making, exposing a shadow network moving poison by the ton while officials hint this was only the visible layer, because when this much fentanyl surfaces at once, it means something bigger just lost control 👇

The Unraveling of a Drug Empire: A Shocking Federal Crackdown in Chicago In the early hours of a seemingly ordinary…

🚨 Governor of California PANICS After Disney’s SHOCK EXIT Rocks Hollywood — Magic FADES, Studios Go Silent, and an Entertainment Empire Starts Cracking 🎬💥 What was once whispered as an impossible rumor detonated into reality as Disney’s departure sent executives scrambling, workers frozen in disbelief, and state leaders rushing to cameras with damage control, because when the company that built dreams quietly packs up, it signals something far darker than a simple business move 👇

The Shocking Exodus: How Disney’s Departure Could Signal Hollywood’s Downfall In a move that has sent tremors through the heart…

🚨 Governor of California UNDER SIEGE as HUNDREDS of CASINOS SHUT DOWN — Neon Goes Dark, Cash Dries Up, and a Gambling Empire COLLAPSES Overnight 🎰💥 What once glittered with promise now flickers in silence as roulette wheels stop spinning, dealers walk out, and entire communities feel the gut punch, while the Governor faces mounting fury and whispers that this shutdown wasn’t accidental but the result of pressure building for years behind closed doors 👇

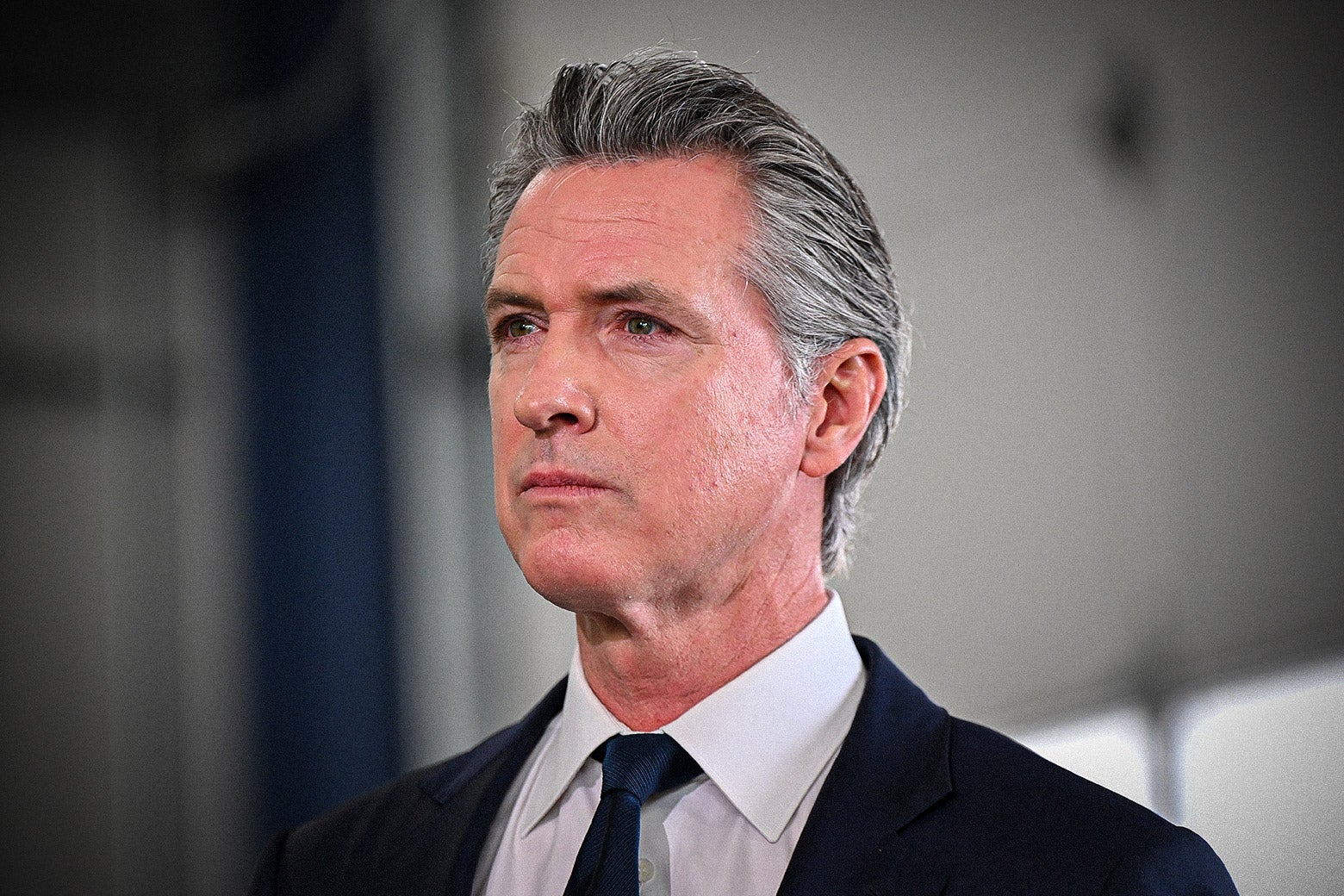

California Casino Collapse: A Governor Under Fire In a shocking turn of events, Governor Gavin Newsom finds himself in the…

🚨 FBI & ICE UNLEASH MIDNIGHT RAID on Hidden Chinese Fentanyl Precursor Hub in California — $500M HAUL EXPOSES a Shadow Supply Chain Feeding America’s Deadliest Crisis 🧪💥 Sirens cut the night as agents cracked open a warehouse no one was supposed to find, uncovering tons of chemicals, coded ledgers, and a money trail that screams scale, while officials whisper this wasn’t a lab but a pipeline, and the real shock isn’t what was seized—it’s how long it allegedly operated in plain sight 👇

The Dawn of Reckoning: FBI’s $500 Million Raid Exposes the Dark Underbelly of Fentanyl Production In a breathtaking early morning…

🚨 CEO of Shell FINALLY RESPONDS After Oregon Governor BEGS Them to RETURN — Boardroom Silence Shatters, Power Shifts, and an Energy Standoff Turns Personal 🛢️💥 Cameras caught the plea, but insiders say the answer was already written as Shell’s CEO broke the silence with a measured response that felt colder than a rejection letter, hinting that trust was burned, terms were broken, and the door may not reopen no matter how loudly leaders call it a “partnership,” because when energy giants walk away, they don’t look back without leverage 👇

The Shell Shock: A Dramatic Response to Oregon’s Plea In a world where energy dictates the pulse of economies, Ben…

🚨 California Governor in SHOCK After Intel Factory SHUTS DOWN — Silicon Valley’s Tech Heart Suffers a BRUTAL Blow No One Saw Coming 💻💥 What was once whispered in boardrooms is now reality as Intel pulls the plug, lights go dark, engineers pack boxes, and an entire tech hub feels the ground shift beneath it, leaving the Governor stunned on camera and insiders admitting this wasn’t a surprise but a slow-motion exit that finally crossed the line from warning to disaster 👇

The Shocking Closure: Intel’s California Fab and the Fall of a Tech Empire In a stunning turn of events that…

End of content

No more pages to load