The Untouchables: Five Banks That Stand Unyielding Amidst the Financial Storm

In a world where financial institutions tremble under the weight of impending collapse, there exists a select group that remains unscathed.

Warren Buffett, the Oracle of Omaha, has long championed these giants, recognizing their unwavering strength and the implicit guarantee that shields them from failure.

As the banking crisis intensifies, many are left in a state of panic.

The headlines scream of bank failures, and the whispers of economic doom echo through the halls of power.

Yet, amidst this chaos, five banks stand as bastions of stability, fortified by regulations designed to protect them at all costs.

These are not merely safer options; they are the titans of the financial world, the Global Systemically Important Banks, or G-SIBs.

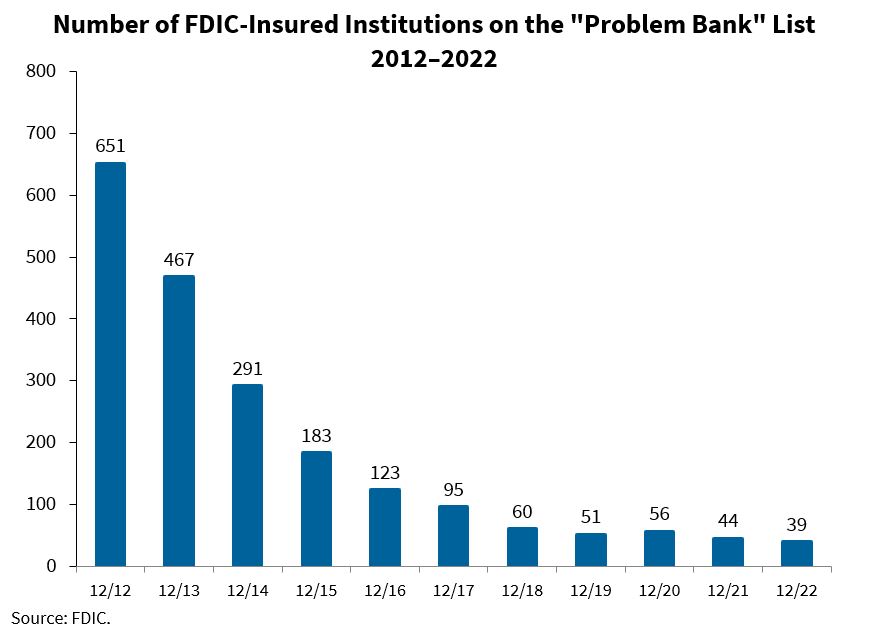

The 2008 Financial Crisis serves as a grim reminder of what happens when these institutions falter.

Regulators, shaken by the near-collapse of the global economy, implemented stringent measures to ensure that certain banks would never face the same fate.

These measures include higher capital requirements and rigorous stress testing, creating a safety net that few can penetrate.

When Silicon Valley Bank fell in 2023, a mass exodus of deposits occurred.

Savvy investors understood the risks and sought refuge in these fortress banks, confident in the protection they offered.

This was not just a flight to safety; it was a testament to the trust placed in institutions that the government has vowed to protect.

So, who are these five untouchable banks? Each one carries the weight of an implicit government guarantee, a promise that their failure would not be tolerated.

They are the backbone of the American financial system, and their stability is paramount to the economy’s health.

Bank of America, with its vast network and resources, stands as a pillar of strength.

Its ability to weather storms, both financial and economic, has made it a preferred choice for those seeking security.

The FDIC data showcases its unmatched resilience, reinforcing the belief that it is too big to fail.

Next is JPMorgan Chase, a behemoth that has consistently proven its mettle.

With a diversified portfolio and a robust capital structure, it is a fortress in the financial landscape.

The confidence of depositors in JPMorgan Chase is palpable, as they flock to this institution in times of uncertainty.

Citigroup follows closely, embodying the spirit of adaptability.

Its global reach and innovative strategies have allowed it to thrive, even in the face of adversity.

The FDIC’s figures highlight its strength, making it a safe haven for those wary of the tumultuous banking environment.

Wells Fargo cannot be overlooked.

Despite past controversies, it has emerged stronger, with a renewed focus on stability and customer trust.

Its commitment to maintaining a solid financial foundation has garnered the loyalty of depositors seeking safety.

Finally, Goldman Sachs, the financial powerhouse known for its investment banking prowess, rounds out this elite group.

Its strategic positioning and deep understanding of market dynamics make it a formidable player in the banking sector.

The implicit guarantee from the government further solidifies its status as a safe harbor amid the storm.

As we dissect the characteristics that make these banks invulnerable, it becomes clear that they are not merely financial institutions; they are symbols of hope in a landscape marred by uncertainty.

The FDIC data serves as a beacon of reassurance, illuminating the path for those seeking refuge from the impending doom of bank failures.

However, this narrative is not without its complexities.

The very existence of these G-SIBs raises questions about the future of banking.

![Small Enough to Fail: Bank Failures in the U.S. (2000-2023) [OC] : r/dataisbeautiful](https://preview.redd.it/small-enough-to-fail-bank-failures-in-the-u-s-2000-2023-v0-j8251grf358c1.png?width=640&crop=smart&auto=webp&s=93ca9581a4483784fed8416d3efe341551826970)

Are we fostering a system where certain banks are deemed too important to fail, thereby encouraging reckless behavior among their leaders? The risks associated with such a framework cannot be ignored, as history has shown us that complacency can lead to catastrophic consequences.

The emotional toll on individuals and families who have witnessed the collapse of their banks is profound.

The fear of losing everything they have worked for weighs heavily on their minds.

Yet, the knowledge that there are banks that will not falter provides a glimmer of hope.

In conclusion, the narrative surrounding these five banks is not just about their financial strength; it is about the trust they inspire in a world fraught with uncertainty.

They are the guardians of our financial future, standing resolute against the tides of economic turmoil.

As we navigate this precarious landscape, it is imperative to recognize the importance of these institutions and the role they play in maintaining stability.

The question remains: will we continue to rely on these giants, or will the system evolve to ensure that no bank is above the law? The answer may determine the fate of our financial future.

As the dust settles, one thing is clear: the story of these banks is far from over, and the implications of their existence will reverberate through the corridors of power for years to come.

Let us not forget the lessons learned from the past.

As we look to the future, the need for vigilance and accountability in the banking sector has never been more crucial.

The untouchables may stand strong today, but the winds of change are always blowing, and the next chapter in this saga is yet to be written.

News

🚨 Something STRANGE Is Happening in JERUSALEM Right Now — A MYSTERIOUS Event That’s Shaking the Holy City to Its Core 🌍💥 The streets of Jerusalem are buzzing with an energy that can’t be explained, and something is unfolding that has both locals and visitors on edge. What’s happening in the Holy City right now could change everything, and the world is watching as the mystery deepens. What is the true nature of this strange occurrence? 👇

Something Strange Is Happening in JERUSALEM Right Now In the heart of Jerusalem, a story unfolds that is as ancient…

🚨 The Resurrection of Christ: Mel Gibson Reveals the Resurrection You’ve NEVER Seen — A Shocking, Unseen Version That Will Leave You Speechless ✝️💥 Mel Gibson has unveiled a version of Christ’s resurrection that no one has seen before, and it’s unlike anything portrayed in history. This shocking new perspective sheds light on the resurrection in a way that could change the very foundation of Christian faith. Get ready to witness a raw, emotional take on the most important event in history. 👇

The Resurrection of Christ: A Shocking Revelation In a world where faith often intertwines with skepticism, Mel Gibson has ventured…

🚨 The Ethiopian Bible Just Revealed What Jesus Said After His Resurrection — A Shocking Truth That Will Shake Your Faith ✝️💥 Hidden for centuries, the Ethiopian Bible has just unveiled a shocking revelation about what Jesus truly said after His resurrection. The words He spoke will challenge everything you thought you knew about the resurrection. What was His final message to the disciples, and why is it more important than ever? This truth could change everything. 👇

The Shocking Revelation: What Jesus Said After His Resurrection In a world where the narratives of faith are often taken…

🚨 Cardinal Tagle’s SHOCKING Message: 3 Signs God Has Already BLESSED YOU — Are You Missing the Miracles Around You? ✝️💥 In a powerful and unexpected message, Cardinal Tagle reveals the 3 undeniable signs that God has already blessed you, and the truth may leave you speechless. From subtle divine whispers to undeniable moments of grace, these signs are often overlooked—but once you see them, your life will never be the same. Are you ready for your eyes to be opened? 👇

Unveiling the Hidden Blessings: Cardinal Tagle’s Revelation That Will Change Your Perspective Forever In a world teeming with chaos and…

🚨 Kroger’s $25 Billion Exit: Major Grocery Chains FLEE Oregon — The Shocking Reason Behind the State’s Retail Exodus 💥🛒 In a move that’s sending shockwaves through the grocery industry, Kroger has announced a $25 billion exit from Oregon, and it’s not alone. Major grocery chains are pulling out of the state, leaving consumers wondering what’s behind this unprecedented departure. Is it the rising costs, tax policies, or something much more explosive? The truth will shock you. 👇

The Disappearance of Grocery Giants: Kroger’s $25 Billion Exit from Oregon In the heart of Portland, a quiet storm is…

🚨 California Governor PANICS as Business Tax Revenue COLLAPSES Overnight — The State Faces an ECONOMIC CATASTROPHE 💥📉 In a shocking development, California has seen its business tax revenue plummet overnight, sending the Governor into a full-blown panic. With millions in lost revenue, the state’s financial future is suddenly in jeopardy. What caused this sudden collapse, and how will California recover from this devastating blow to its economy? The fallout is just beginning. 👇

California’s Fiscal Nightmare: The Collapse of Business Tax Revenue In a startling turn of events, California finds itself grappling with…

End of content

No more pages to load