The Great Banking Exodus: California’s Financial Apocalypse

In a stunning turn of events, California finds itself at the brink of a financial apocalypse.

Once the crown jewel of the American economy, the Golden State is now witnessing a mass exodus of its most powerful banking institutions.

These financial giants, once deeply rooted in California soil, are packing their bags and relocating to the more business-friendly climes of Texas.

This dramatic shift is not just a corporate decision; it is a seismic event that threatens the very fabric of California’s economic future.

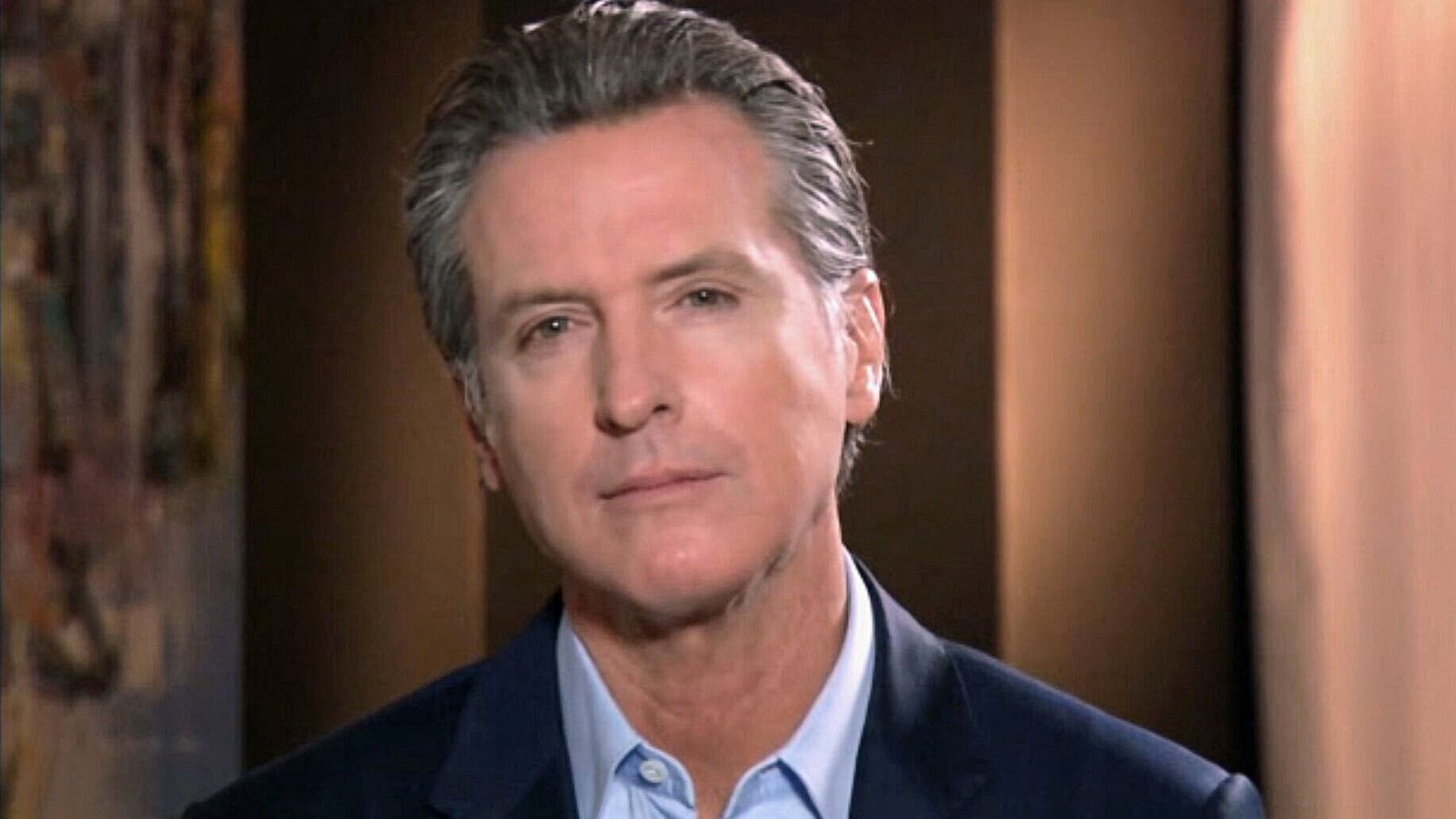

The tale begins under the watchful eye of Governor Gavin Newsom.

His administration, marked by rising taxes and aggressive regulatory measures, has created an environment that many businesses find increasingly hostile.

The whispers of discontent have grown into a deafening roar as century-old financial titans, once proud to call California home, now view their future in the Lone Star State.

The reasons are stark and alarming: high taxes, unpredictable regulations, and a climate that seems to favor bureaucracy over business.

As we delve deeper into this crisis, the timeline of events paints a grim picture.

Over the past few years, major banks have announced plans to shift their headquarters, taking with them not just their corporate offices but billions in capital, thousands of high-paying jobs, and a significant chunk of tax revenue.

The implications of this exodus are staggering, sending shockwaves through the state’s economy and leaving workers, small businesses, and real estate in disarray.

John Doe, a financial analyst who has spent decades working in California’s banking sector, speaks candidly about the situation.

He describes the atmosphere within the industry as one of desperation and uncertainty.

Many of his colleagues are now contemplating their futures, unsure if they will have jobs in a state that seems to be turning its back on them.

The emotional toll is palpable as families face the prospect of uprooting their lives in search of better opportunities elsewhere.

The narrative shifts to Jane Smith, a small business owner who has felt the repercussions of this banking exodus firsthand.

With fewer banks willing to lend to local businesses, Jane has watched her dreams of expansion crumble.

The once-thriving economy that supported her café is now a shadow of its former self.

She recalls the days when customers flocked to her establishment, but now, with rising costs and dwindling foot traffic, survival feels like a daily struggle.

Jane’s story is a microcosm of the larger crisis unfolding across the state.

As we trace the economic domino effect, it becomes clear that the fallout extends beyond the banking sector.

The real estate market, once a beacon of hope for many Californians, is now facing an uncertain future.

With banks relocating, the demand for commercial real estate is plummeting.

Property values are beginning to reflect this shift, and homeowners are left wondering if their investments will ever regain their worth.

The sense of betrayal is thick in the air, as residents grapple with the reality that their beloved state is no longer the land of opportunity it once was.

In the midst of this chaos, Governor Newsom finds himself at a crossroads.

His administration’s policies have been called into question, and the mounting criticism is impossible to ignore.

As banking giants flee, the governor faces a growing backlash from constituents who feel abandoned.

The question looms large: Can California recover from this economic catastrophe, or is this the beginning of a long-term decline?

The stakes are high, and the implications of this banking exodus extend far beyond the state’s borders.

As California grapples with the fallout, the nation watches closely.

What does this mean for the American economy as a whole? Will other states follow Texas’s lead, luring businesses away from California with promises of lower taxes and fewer regulations? The answer remains uncertain, but one thing is clear: the landscape of American business is shifting, and California is at risk of losing its status as an economic powerhouse.

In the end, this story is not just about banks and taxes; it is about people.

It is about the families who are left to pick up the pieces in the wake of corporate decisions made far above their heads.

It is about the small business owners like Jane Smith, who are fighting to keep their dreams alive in an increasingly hostile environment.

It is about the workers like John Doe, who are left questioning their future in a state that no longer seems to want them.

As we reflect on this unfolding drama, one cannot help but feel a sense of urgency.

The conversation must shift from blame to action.

What can be done to reverse this trend? How can California reclaim its status as a land of opportunity? The answers are not easy, but the time for action is now.

The future of California hangs in the balance, and the world is watching.

In conclusion, the banking exodus from California is a wake-up call.

It is a stark reminder that the American Dream is fragile and can be shattered by mismanagement and neglect.

The question remains: will California rise from the ashes, or will it succumb to the forces that threaten to dismantle its economy? Only time will tell, but the urgency for change has never been greater.

News

🚨 Even Skeptics Are STRUGGLING With the Latest 3I/ATLAS Data — A Discovery So Shocking It’s Changing Everything 🔥📊 The latest data from the 3I/ATLAS experiment has even the harshest skeptics scratching their heads. What’s been uncovered is so groundbreaking, it’s forcing scientists to rethink everything they thought they knew about the universe. The implications of this discovery could change the course of science forever. What did the data reveal, and why is it shaking the scientific community to its core? 👇

Unveiling the Enigma: The Shocking Truth Behind 3I/ATLAS The cosmos has always held its secrets close, but the latest revelations…

🚨 A Giant Israel Ignored — and His SHOCKING Jerusalem Discovery Will Change Everything 💥🌍 For years, this giant of history was overlooked by Israel, but what he’s just uncovered in Jerusalem is beyond anything expected. The discovery threatens to shake the foundations of everything we know about the city’s past. What secrets does this towering figure of research hold, and why did Israel choose to ignore his findings? The truth could change the way we see Jerusalem forever. 👇

A Shocking Revelation: The Legacy of Gabi Barkay and His Unseen Discoveries In the heart of Jerusalem, a city steeped in history…

🚨 Underwater Drone REACHES the Bottom of the Puerto Rico Trench — The Footage Reveals SHOCKING Secrets No One Expected 🌊💥 In a world-first achievement, an underwater drone has descended to the bottom of the Puerto Rico Trench, capturing footage that no one was prepared for. The mysteries of the ocean depths have just been cracked wide open, revealing strange creatures, uncharted geological formations, and secrets that challenge everything we thought we knew about our planet. This is a discovery that could change oceanography forever. 👇

Underwater Dr.one Reaches the Bottom of the Puerto Rico Trench — The Footage Shocked the World In a groundbreaking revelation…

🚨 Soviet Venus Missions Revealed Shocking Footage — What They Saw on the Red Planet Will Leave You SPEECHLESS 🚀💥 Long buried in secret files, Soviet missions to Venus captured footage that has just surfaced, and it’s far more terrifying than anyone imagined. From strange anomalies to unexplainable phenomena, these images challenge everything we thought we knew about the planet. What’s on Venus, and why was this footage kept hidden for so long? Get ready for a revelation that will change everything. 👇

The Shocking Revelations from the Soviet Missions to Venus For decades, Venus was a mystery shrouded in thick clouds and…

🚨 “I Show You The Original World Map They Didn’t Want You to See” — Graham Hancock Exposes Hidden History That Will SHOCK the World 🌍💥 In a groundbreaking revelation, Graham Hancock has unveiled the original world map—one so controversial that it’s been kept hidden for centuries. What this map reveals will change everything you thought you knew about ancient civilizations and the true history of our planet. Prepare for a journey through time that no one wanted you to take. 👇

The Hidden Truth Behind the Original World Map: A Shocking Revelation by Graham Hancock In a world where history is…

🚨 Shocking Evidence Found in China: Ancient Documents Reveal They Knew About Jesus’ Death AS IT HAPPENED! 💥📜 In a mind-blowing discovery, ancient documents from China have surfaced that suggest knowledge of Jesus’ crucifixion was known in real-time, thousands of miles away. These texts, hidden for centuries, reveal a stunning connection between the East and the West, and the implications are far greater than anyone could have imagined. What was hidden in these documents, and how does this rewrite history? 👇

Shocking Revelation: Ancient Chinese Records Confirm Jesus’ Death In a world where history often feels distant and fragmented, a startling…

End of content

No more pages to load