The Great Depression of 1929 stands as one of the most severe economic crises in modern history.

It was a catastrophic event that not only devastated the American economy but also had profound ripple effects across the globe.

This period was marked by widespread unemployment, bank failures, and a collapse in industrial production that plunged millions into poverty and despair.

The causes of the Great Depression are complex, involving both structural weaknesses in the economy and a series of critical policy mistakes that exacerbated the crisis.

In the aftermath of World War I, the United States emerged as a dominant economic power.

The 1920s, often called the “Roaring Twenties,” were characterized by rapid industrial growth, technological innovation, and a booming stock market.

Many Americans believed that prosperity was permanent and invested heavily in stocks, often on margin, which meant borrowing money to buy shares.

This speculative bubble inflated stock prices far beyond their real value, creating an unstable financial environment.

The stock market crash of October 1929 marked the beginning of the Great Depression.

On “Black Tuesday,” October 29, stock prices plummeted, wiping out millions of dollars in wealth almost overnight.

Panic selling ensued as investors rushed to liquidate their holdings, leading to a downward spiral that destroyed confidence in the financial system.

However, the crash itself was not the sole cause of the Depression but rather a trigger that exposed deeper economic vulnerabilities.

Several underlying factors contributed to the crisis.

One major issue was the uneven distribution of wealth during the 1920s.

While industrial production soared, wages for many workers remained stagnant, limiting consumer purchasing power.

This imbalance meant that much of the economy depended on credit and borrowing to sustain consumption.

Another critical factor was the agricultural sector’s distress.

Farmers faced falling crop prices and mounting debts, which reduced their ability to participate in the economic boom.

This rural hardship contrasted sharply with urban prosperity and added to the overall economic instability.

The banking system was also fragile.

Many banks had invested heavily in the stock market or made risky loans.

When the crash occurred, banks faced massive withdrawals from panicked depositors, leading to numerous bank failures.

The lack of federal insurance for deposits meant that many people lost their savings, further undermining confidence.

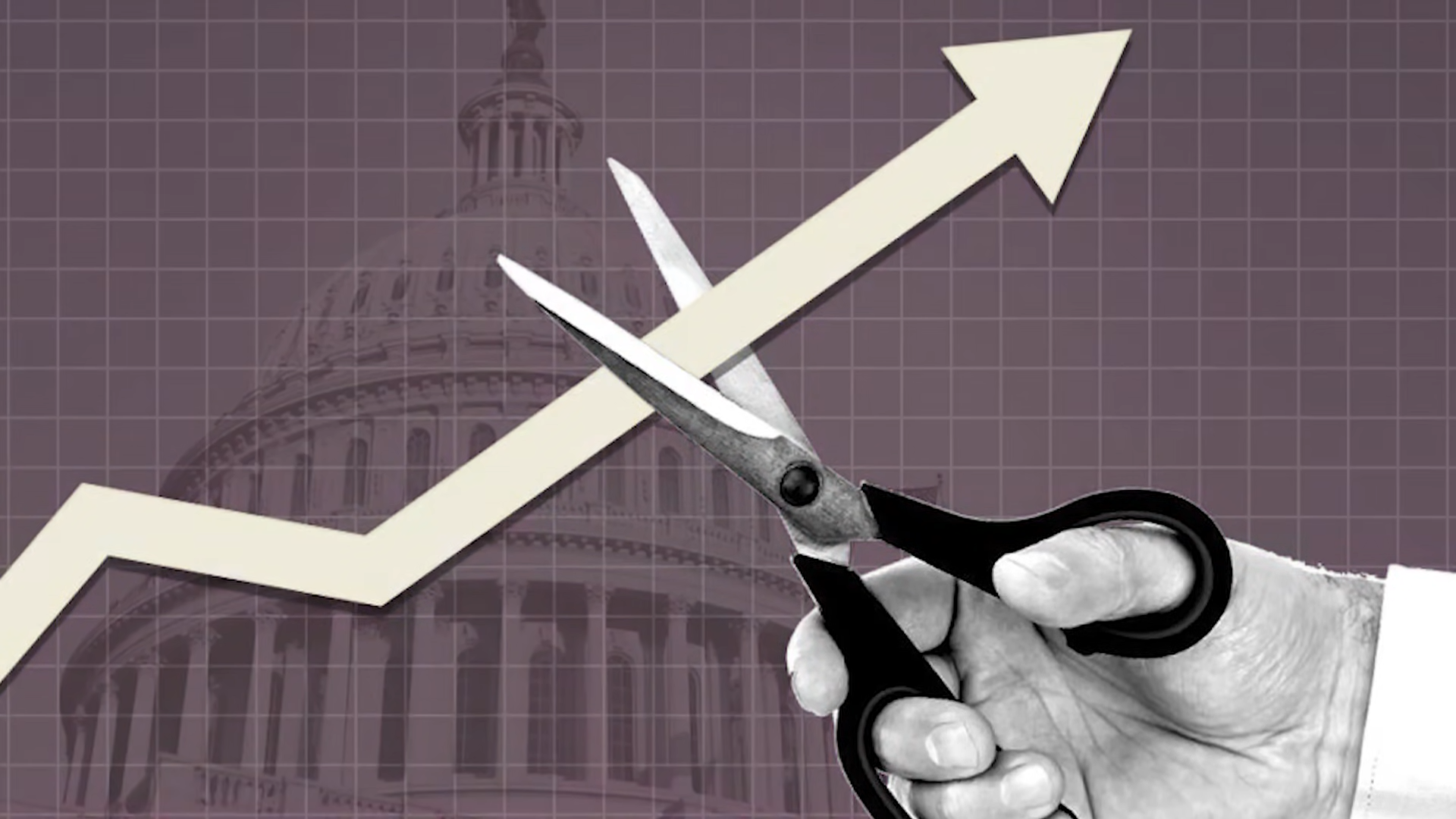

Government policies at the time worsened the situation.

The Federal Reserve, tasked with managing monetary policy, initially raised interest rates to protect the dollar, which restricted credit availability.

This move deepened the economic contraction by making borrowing more expensive for businesses and consumers.

Additionally, the Smoot-Hawley Tariff Act of 1930, intended to protect American industries by raising tariffs on imported goods, backfired.

It triggered retaliatory tariffs from other countries, leading to a sharp decline in international trade.

This protectionism further strangled global economic recovery and worsened the Depression worldwide.

The social consequences of the Great Depression were devastating.

Unemployment in the United States soared to nearly 25 percent at its peak.

Millions of families lost their homes and livelihoods, leading to widespread poverty and homelessness.

Shantytowns, derisively called “Hoovervilles” after President Herbert Hoover, sprang up across the country as desperate people sought shelter.

The psychological impact was equally profound.

The loss of economic security shattered the American Dream for many and created a climate of fear and uncertainty.

People struggled not only to survive but also to find hope amid the despair.

President Herbert Hoover’s response to the crisis was widely criticized.

Hoover believed in limited government intervention and emphasized voluntary cooperation between businesses and charities to address the problems.

However, these efforts were insufficient to stem the economic decline or provide adequate relief to suffering Americans.

The turning point came with the election of Franklin D. Roosevelt in 1932.

Roosevelt’s New Deal introduced a series of bold and unprecedented government programs aimed at economic recovery, financial reform, and social welfare.

These policies included public works projects to create jobs, banking reforms to restore confidence, and social safety nets like Social Security.

The New Deal fundamentally transformed the role of the federal government in American life.

It established the principle that government had a responsibility to intervene in the economy to protect citizens from the worst effects of economic downturns.

While the New Deal did not end the Depression by itself, it helped stabilize the economy and provided much-needed relief and hope.

World War II ultimately brought full economic recovery as wartime production created jobs and revitalized industry.

However, the lessons of the Great Depression continue to resonate in economic policy and theory.

The Great Depression revealed the dangers of speculative bubbles, inadequate financial regulation, and protectionist trade policies.

It highlighted the importance of government oversight and social safety nets to maintain economic stability and protect vulnerable populations.

Moreover, the crisis reshaped American society and politics.

It fostered a greater awareness of economic inequality and the need for collective action.

The experience also influenced future generations’ attitudes toward risk, investment, and the role of government.

Internationally, the Depression contributed to political instability and the rise of extremist movements in Europe, setting the stage for World War II.

The global nature of the crisis underscored the interconnectedness of economies and the importance of international cooperation.

In retrospect, the Great Depression was a period of profound hardship but also of significant transformation.

It forced a reevaluation of economic assumptions and led to innovations in policy and governance that continue to shape the modern world.

Understanding this historical episode is crucial not only for appreciating the past but also for navigating present and future economic challenges.

The story of the Great Depression reminds us that economic prosperity is fragile and requires vigilance, wisdom, and compassion to sustain.

In conclusion, the Great Depression of 1929 was a watershed moment in American and world history.

It was a time when economic missteps and policy failures combined with structural weaknesses to create a crisis of unprecedented scale.

Yet, through adversity came change, as new ideas and institutions emerged to address the flaws exposed by the catastrophe.

The legacy of the Great Depression endures, offering valuable lessons on the risks of financial speculation, the necessity of sound regulation, and the vital role of government in safeguarding economic well-being.

News

When North Korea Decided to Attack the Most Fortified and Deadly US Battleship Ever Seen

USS Wisconsin, one of the most powerful battleships ever developed by the United States Navy, stands as a remarkable symbol…

The American Civil War: 1861 – 1865 | History Documentary

The history of the United States is deeply intertwined with its military conflicts, which have shaped the nation’s identity, borders,…

Was Henry Kissinger a War Criminal?

Henry Kissinger, who passed away recently at the age of 100, remains one of the most polarizing figures in American…

Jungle Ambush: The Nightmare of Vietnam’s War

The Vietnam War stands as one of the most harrowing and complex conflicts in modern history, a brutal struggle that…

THE PACIFIC WAR – Japan versus the US | History Documentary

The Pacific War, a monumental chapter in the annals of World War II, stands as a testament to the brutal…

Hitler’s Biggest Blunders: When The Cracks In The Third Reich Began To Show

At the height of Adolf Hitler’s power, the Third Reich appeared invincible, sweeping across Europe with an iron fist and…

End of content

No more pages to load