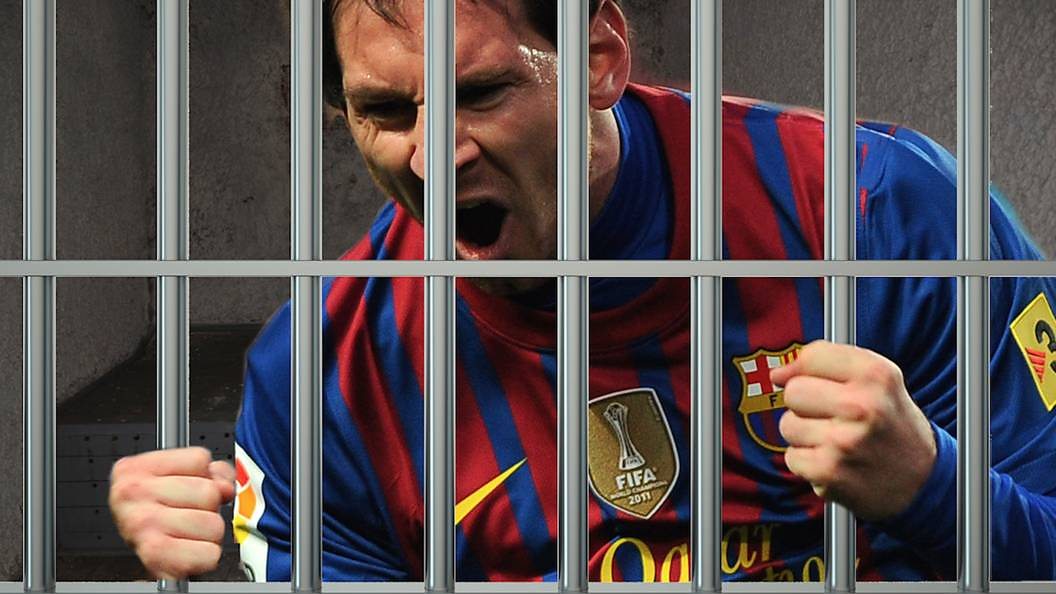

Is Lionel Messi Going to Jail? Understanding the Tax Fraud Case

In July 2016, the sports world was rocked by the news that Lionel Messi, the celebrated Argentine footballer and Barcelona star, had been sentenced to 21 months in prison for tax fraud.

This announcement raised eyebrows and sparked widespread discussion among fans, commentators, and legal experts alike.

Given Messi’s status as one of the greatest football players of all time, the implications of this ruling were significant, not only for him personally but also for the broader conversation about financial responsibility among athletes.

This article delves into the details of Messi’s case, the legal framework surrounding it, and the potential consequences of his sentencing.

The Background of the Case

The legal troubles for Lionel Messi and his father, Jorge Messi, began when Spanish authorities launched an investigation into their financial dealings.

The investigation focused on the income derived from Messi’s image rights, which is a substantial revenue stream for many professional athletes.

It was discovered that Messi and his father had established offshore companies in countries like Belize and Uruguay to avoid paying taxes on earnings that should have been reported in Spain.

According to the Spanish authorities, Messi and his father failed to pay approximately €4.1 million (around $4.6 million) in taxes, along with interest and penalties.

The case highlighted the complexities of tax law and the responsibilities that come with significant wealth, particularly for public figures like Messi.

Although Messi had achieved immense success on the football field, his financial oversight—or lack thereof—would soon put him in a precarious legal position.

The Court Ruling

After a thorough investigation and subsequent trial, a Spanish court found both Messi and his father guilty of three counts of tax fraud.

The court handed down a sentence of 21 months in prison for each, but under Spanish law, first-time offenders who receive a sentence of two years or less can often avoid serving jail time if they do not have a prior criminal record.

This provision raised questions about whether Messi would actually serve his sentence.

Messi’s legal team argued that he had not intentionally evaded taxes, asserting that he had relied on his father’s management of their finances.

Messi maintained that he was unaware of the specifics regarding tax obligations and had trusted his father and financial advisors to handle these matters.

Despite these claims, the court’s ruling indicated that the responsibility ultimately fell on Messi as the income earner.

Public Reaction

The news of Messi’s sentencing elicited a wide range of reactions from fans, fellow athletes, and the media.

Many supporters expressed shock and disappointment, as Messi had long been regarded as a role model both on and off the pitch.

The notion that someone with such a pristine public image could be embroiled in a tax fraud scandal was difficult for many to accept.

Social media platforms were flooded with opinions and commentary regarding the case.

Some fans defended Messi, arguing that he should not be held solely responsible for the financial decisions made by his father and advisors.

Others, however, expressed frustration, suggesting that as a wealthy individual, Messi should have been more aware of his financial responsibilities.

This case also ignited discussions about the broader implications of tax evasion among high-profile athletes.

Many commentators noted that the scrutiny faced by Messi was indicative of a larger trend in which public figures are held accountable for their financial conduct.

The ruling served as a reminder that fame and success do not exempt individuals from legal obligations.

The Legal Framework

The legal framework surrounding tax fraud in Spain is stringent, and authorities have become increasingly vigilant in pursuing cases involving wealthy individuals.

The Spanish government has made concerted efforts to crack down on tax evasion, particularly among athletes and celebrities who often have complex financial arrangements.

In Messi’s case, the court’s ruling reflected a broader trend of holding public figures accountable for their financial conduct.

The decision to impose a prison sentence, even if it was likely to be suspended, sent a clear message that tax evasion would not be tolerated, regardless of one’s status or wealth.

The Aftermath of the Ruling

Following the sentencing, Messi’s legal team took steps to address the situation.

They sought to appeal the decision, arguing that the punishment was excessive given Messi’s lack of intent to commit fraud.

Additionally, Messi and his father paid the outstanding tax bill, including penalties, in an effort to rectify the situation and demonstrate their willingness to comply with tax laws.

In the months that followed, Messi continued to perform at an elite level on the pitch, contributing to FC Barcelona’s success in various competitions.

His focus on football remained unwavering, and he was determined not to let the legal issues overshadow his career.

Changes in Financial Management

The tax fraud case served as a wake-up call for Messi and many other athletes regarding the importance of financial literacy and oversight.

Following the scandal, Messi reportedly took a more active role in managing his finances, ensuring that he was better informed about his financial obligations.

This shift highlights a critical issue for many athletes: the need for comprehensive financial education and support.

Many professional athletes achieve significant wealth at a young age and may not possess the experience or knowledge to navigate complex financial matters.

This situation can lead to vulnerabilities, making them susceptible to financial mismanagement and legal troubles.

Broader Implications for Athletes

Messi’s case is not an isolated incident; it reflects a broader trend among athletes and celebrities facing legal challenges related to financial misconduct.

High-profile athletes often earn substantial sums from endorsements, sponsorships, and appearances, leading to complex financial situations that require careful management.

The scrutiny that comes with fame can amplify the consequences of financial missteps.

Athletes who find themselves in legal trouble may face reputational damage, loss of endorsements, and public backlash.

For many, the pressure to maintain a certain image can lead to poor financial decisions or reliance on advisors who may not have their best interests at heart.

Conclusion

Lionel Messi’s sentencing for tax fraud in July 2016 was a significant event that raised important questions about the responsibilities of high-profile athletes regarding their financial affairs.

While the court’s ruling emphasized the need for accountability, it also highlighted the complexities of managing wealth in the public eye.

As Messi navigated the legal challenges, he remained focused on his career, demonstrating resilience and determination.

The case served as a reminder for athletes to prioritize financial literacy and to engage actively in their financial management to avoid similar pitfalls.

In the years since the sentencing, Messi has continued to excel on the football field, solidifying his legacy as one of the greatest players in history.

His experience underscores the importance of understanding financial obligations, regardless of one’s success or status, and serves as a cautionary tale for athletes navigating the complexities of fame and fortune.

As the sports world continues to evolve, the lessons learned from Messi’s case will undoubtedly resonate with current and future generations of athletes, emphasizing the need for vigilance and integrity in all aspects of their lives.

News

The Untold Story of Jennifer Aniston: Hollywood’s Most Down-to-Earth Star Revealed!

Introduction Jennifer Aniston is a name that resonates with millions around the world. From her iconic role as Rachel Green…

😼 Unlocking the Secrets of Jennifer Aniston’s Jaw-Dropping Fitness Routine 💪 What You Didn’t Know About Her Ageless Glow and Relentless Discipline 👇

Introduction Jennifer Aniston has long been celebrated not just for her acting prowess but also for her stunning physique. At…

😼 The Unexpected Side of Jennifer Aniston 😂 Her Wild Rendition of “Baby Got Back” That Left the Entire Studio in Tears of Laughter 👇 Who knew America’s sweetheart could drop bars like that? During what was supposed to be a calm, polished interview, Jennifer Aniston stunned everyone by busting out a shockingly perfect — and side-splitting — rendition of “Baby Got Back.” The audience went feral, the host nearly fell off his chair, and even Jen couldn’t hold back her laughter. For a brief, glorious moment, the queen of calm turned into the queen of comedy — and Hollywood is still talking about it.👇

Introduction When you think of Jennifer Aniston, what comes to mind? The iconic Rachel Green from “Friends”? The glamorous Hollywood…

The Astonishing Secrets Behind Jennifer Aniston’s Ageless Beauty at 54

Introduction At 54, Jennifer Aniston defies the passage of time, captivating us with her youthful looks and vibrant energy. Many…

How Jennifer Aniston and Reese Witherspoon’s Sisterhood Transcends Time

Introduction In the world of Hollywood, where friendships can often be fleeting and relationships are frequently put under the microscope,…

What Really Happened Behind the Scenes of The Morning Show

The Rumor That Started It All It began as a whisper on social media, a seemingly harmless observation by a…

End of content

No more pages to load