California Energy Shock Exposes Fragile Fuel System and Growing Dependence on Distant Supply Lines

California woke to an energy shock that few leaders had predicted and fewer drivers were prepared to face.

Gasoline prices surged overnight to an average of four dollars and thirty four cents per gallon, nearly two dollars higher than the national level.

The sudden spike followed the closure of two massive oil refineries that together removed nearly one fifth of the state fuel supply.

What began as a supply adjustment quickly became a statewide crisis that now threatens families, businesses, and the broader economy.

By dawn on January twenty two, long lines formed at stations across Los Angeles, San Francisco, and the Central Valley.

Drivers arrived before sunrise hoping to fill tanks before prices climbed further.

Electronic signs flickered as numbers changed upward within hours.

Ride share operators logged off early.

Delivery fleets slowed routes.

Farmers in the Central Valley recalculated planting schedules and transport costs.

Every mile driven suddenly carried a heavier burden.

The price gap between California and the rest of the nation reached a historic level.

While most Americans paid less than three dollars per gallon, Californians faced a premium that felt punitive rather than temporary.

Economists noted that the difference reflected more than market forces.

It revealed a fragile fuel system stretched thin by policy decisions, refinery closures, and limited alternatives.

The first blow had landed months earlier.

In October two thousand twenty five, the Phillips sixty six refinery in Los Angeles shut down after more than a century of operation.

The plant had processed one hundred thirty nine thousand barrels per day and supported hundreds of skilled workers.

Six months later, Valero closed its Benicia facility near the Bay Area, removing another one hundred forty five thousand barrels per day.

Together the closures erased nearly seventeen and a half percent of California refining capacity in less than one year.

The consequences spread quickly.

More than one thousand three hundred refinery workers lost stable union jobs that had supported families for decades.

Contractors, truck drivers, equipment suppliers, and port operators saw contracts vanish.

Entire communities built around refinery payrolls faced uncertain futures.

Local tax bases weakened just as social needs increased.

With only seven refineries remaining by mid two thousand twenty six, California now operates with the lowest refining count in modern history.

The margin for error has nearly disappeared.

Any disruption, whether from a fire, an earthquake, or a labor dispute, now carries the potential to send prices soaring overnight.

State officials acknowledged the strain but offered few immediate solutions.

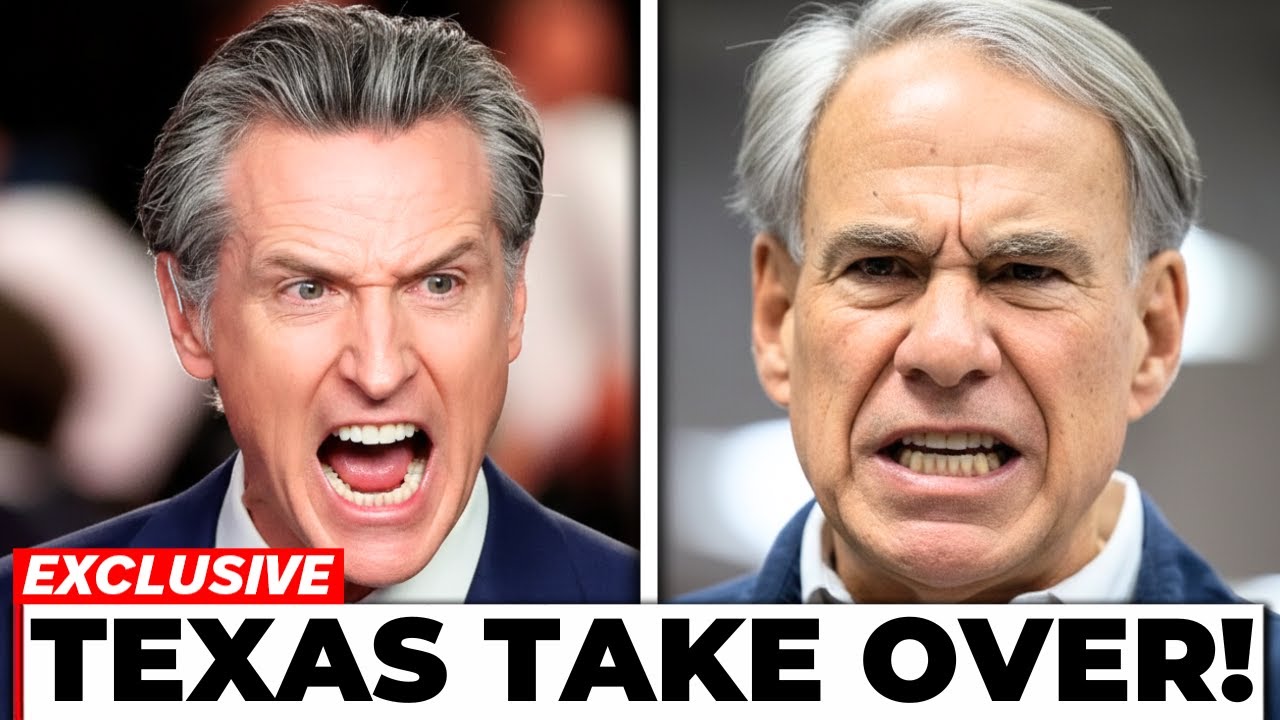

At a hurried press conference in Sacramento, Governor Gavin Newsom urged patience and promised action to stabilize prices.

His administration pointed to new laws aimed at curbing price manipulation and expanding consumer protections.

Yet relief remained elusive as wholesale markets tightened and retail prices continued their climb.

Energy analysts warned that the crisis was only beginning.

Dr Karen Miller of the University of California at Davis projected that average prices could rise by more than one dollar per gallon by late summer.

Professor Michael Mishra of the University of Southern California issued a starker forecast, suggesting that without major new supply lines prices could approach eight dollars per gallon by the end of the year.

In extreme scenarios, diesel prices could exceed ten dollars, driving food and freight costs sharply higher.

Behind the projections lies a sobering statistic.

California maintains only eleven to twelve days of finished gasoline in reserve, far less than most large states.

This limited buffer leaves the market vulnerable to even minor disruptions.

A shipping delay at a port or a mechanical failure at a remaining refinery could leave stations dry within days.

The crisis has revived a controversial proposal that once seemed politically unthinkable.

A consortium led by Phillips sixty six and Kinder Morgan has proposed a thirteen hundred mile pipeline from Texas to California capable of delivering two hundred thousand barrels per day by two thousand twenty nine.

Known as the Western Gateway project, the line would reverse decades of westward independence by making California reliant on fuel from the Gulf Coast.

Supporters call the pipeline a lifeline.

Company executives argue that without new infrastructure the state will face recurring shortages and crippling price spikes.

Regional distributors from Nevada, Arizona, and Oregon have expressed interest, fearing that California shortages will ripple across the West.

Critics see irony and risk.

California policies designed to accelerate a transition away from fossil fuels now appear to have weakened energy security.

A gas tax of more than seventy cents per gallon, strict emissions rules, and the low carbon fuel standard have driven up costs and discouraged long term investment.

The planned ban on new gasoline vehicle sales by two thousand thirty five has further chilled refinery expansion.

Political fallout has been swift.

Republican lawmakers accuse the administration of sacrificing affordability for ideology.

Democratic leaders defend climate goals but acknowledge that the transition has created vulnerabilities.

Military officials quietly express concern that fuel shortages could affect operations at more than thirty bases that depend on local refining capacity.

Neighboring states feel the pressure.

Nevada relies on California for nearly ninety percent of its gasoline.

Arizona imports one third of its supply from California refineries.

Emergency task forces now monitor inventories daily.

Trucking companies warn that rationing could disrupt regional supply chains within weeks.

State legislators have proposed emergency measures.

One bill authorizes new drilling permits in Kern County.

Another allows broader use of ethanol blended fuels.

The administration has explored selling shuttered refineries to new operators, but no buyers have emerged willing to face regulatory hurdles and uncertain demand.

For ordinary residents the debate feels distant compared with the immediate cost at the pump.

Families cut back on travel and entertainment.

Small businesses delay hiring.

Delivery fees rise.

Inflation pressures intensify across sectors from groceries to construction.

Energy historians note that California has faced fuel crises before, but rarely with such limited options.

In earlier decades new refineries and pipelines could be built quickly.

Today environmental reviews, local opposition, and shifting policy goals slow every project.

The result is a system that depends increasingly on distant suppliers and just in time logistics.

The Western Gateway pipeline now symbolizes both hope and warning.

If built, it could stabilize supplies and narrow the price gap within a few years.

If delayed or blocked, California may confront repeated shortages and a permanent premium at the pump.

Experts emphasize that no single project will solve the problem.

A durable solution requires balancing climate goals with reliability, investing in storage and alternative fuels, modernizing refineries that remain, and coordinating with neighboring states.

Without such planning, the state risks trading one form of dependence for another.

As prices continue to climb, trust erodes.

Drivers question whether leaders understand the scale of the problem.

Businesses wonder how long they can absorb rising costs.

Communities once anchored by refinery jobs face uncertain futures.

The crisis has revealed an uncomfortable truth.

Energy transitions are complex and costly, and missteps can leave even the richest state exposed.

California now stands at a crossroads where decisions made in the coming months will shape affordability, security, and independence for years to come.

For now the signs at the pump tell the story more clearly than any policy statement.

Four dollars and thirty four cents today.

Perhaps five tomorrow.

And a question that grows louder with every mile driven.

Who will control the lifeline when the next shock arrives.

News

Girl Vanished Playing With Her Dog — 6 Months Later, a Stranger Shows Up With Her Dog..

.

6p

In March of 2005, 8-year-old Lily Brennan ran outside to play fetch with her dog in their quiet Virginia neighborhood….

Girl Vanished From Her Living Room in 1998 — 16 Years Later Her Brother Cuts Open Her Teddy Bear…

In the summer of 1998, 7-year-old Hannah Keller vanished from her family’s living room while cartoons played on the TV….

Family Vanished in 1994 — 10 Years Later Police Decide To Look At The Old Family Camera… 6p

In September of 1994, the Bennett family, Robert, Ellen, and their two children, packed their bags for a weekend trip…

8 Years After His Sister Vanished, He Found Her Diary — What It Said Made Him Call Police… In the summer of 2005, twelve-year-old Emma Caldwell vanished from her bedroom three days before her thirteenth birthday party. No broken window.

No sign of struggle.

Her door was still locked from the inside when her parents found her bed empty at dawn.

Eight years later, her brother was cleaning out their late grandmother’s attic when he found it wedged behind a loose floorboard, pages yellowed with age and fear.

What he read in those faded pages made him call the police immediately, and revealed a secret so dark that it shocked an entire town.

In the summer of 2005, 12-year-old Emma Caldwell vanished from her bedroom three days before her 13th birthday party. No…

The Expert Who Reviewed Earhart’s Newly Found Wreckage Now Reveals What Was Really Inside For decades, the wreckage linked to Amelia Earhart was dismissed as meaningless debris, filed away and forgotten by history. But now, the aviation expert who was granted rare access to the newly discovered remains is finally breaking his silence — and what he describes could change everything we thought we knew.

Hidden markings, unfamiliar materials, and a sealed compartment no one reported before are raising explosive new questions about her final flight.

Was this evidence overlooked by accident, or deliberately concealed to protect a deeper secret? Click the article link in the comment and uncover what was really found inside the wreckage that could rewrite the greatest mystery in aviation history.

One of the greatest mysteries in aviation history has returned to public attention after a discovery on the floor of…

Governor of Illinois PANICS After Boeing LEAVES Chicago!

Boeing sold its former Chicago headquarters for twenty two million dollars, a fraction of what it paid two decades earlier….

End of content

No more pages to load