A McDonald’s restaurant that served customers for three decades has permanently closed its doors, not because of declining demand or poor food quality, but because the financial model that once sustained it no longer works.

The closure, which took place in San Francisco in mid 2024, has become a symbol of a much broader transformation unfolding across California’s fast food industry.

The restaurant was located at Stonestown Galleria and had been operated by franchisee Scott Rodrik for thirty years.

In June 2024, a handwritten notice appeared on the door informing customers that the business had reached the end of its viability.

Rodrik cited unprecedented changes to California’s economic environment combined with poorly timed legislative mandates that narrowed the path forward for the restaurant.

Behind the carefully worded explanation was a blunt reality.

The numbers no longer added up.

Rodrik’s experience is far from isolated.

Across California, fast food operators are facing a convergence of rising labor costs, higher food and utility prices, declining in store traffic, and changing consumer behavior.

Over the past eighteen months, the state’s fast food sector has experienced significant job losses.

Estimates vary depending on the source, but studies suggest between ten thousand and twenty three thousand jobs have disappeared.

Even the most conservative analyses confirm that employment has declined while the rest of the country has seen growth in the same sector.

The catalyst for much of this disruption was a major policy change that took effect on April 1, 2024.

On that date, California raised the minimum wage for fast food workers from sixteen dollars to twenty dollars per hour.

The law applies to chains with sixty or more locations nationwide and covers more than five hundred thousand workers across approximately thirty thousand restaurants.

Overnight, labor costs increased by twenty five percent for a massive segment of the industry.

At first glance, the wage increase appeared to be an unambiguous victory for workers.

A full time employee earning twenty dollars per hour would make more than forty one thousand dollars per year.

However, multiple independent studies have since shown that the economic consequences were more complex and, in many cases, severe.

In July 2025, economists affiliated with the National Bureau of Economic Research released a study comparing California to other states.

Their analysis found that the fast food sector lost roughly eighteen thousand jobs relative to what would have occurred without the wage increase.

Employment declined by nearly three percent while fast food employment continued to grow nationally.

Another economist, Christopher Thornberg of Beacon Economics, estimated job losses at more than twenty three thousand over a single year.

Data from the California Employment Development Department showed a reduction of approximately twenty one thousand five hundred jobs in limited service restaurants.

Perhaps most striking was a study conducted by the Berkeley Research Group and funded by the same labor union that had advocated for the wage increase.

Even this analysis found that more than ten thousand jobs were lost, describing the decline as the steepest outside of the Great Recession and the pandemic.

Although the estimates differed, the conclusion was consistent.

Employment declined sharply following the wage hike.

Notably, the contraction began before the law even took effect.

In late 2023, Pizza Hut franchises across California announced plans to eliminate all delivery driver positions.

More than twelve hundred workers were laid off across Southern and Northern California, as well as neighboring regions.

The decision was made months in advance, based on projections showing that delivery operations would become unprofitable under the new wage structure.

Longtime drivers received minimal severance, and customers were redirected to third party delivery platforms.

Other chains soon followed.

Rubio’s Coastal Grill, the San Diego based company credited with popularizing the fish taco in the United States, closed forty eight California locations on May 31, 2024.

Employees arrived for work to find doors locked and jobs gone.

Days later, the company filed for Chapter Eleven bankruptcy, reporting more than one billion dollars in debt and less than thirty million dollars in available cash.

It was the second bankruptcy filing for the company in four years.

Company leadership cited multiple factors behind the collapse, including reduced in store traffic due to work from home practices, rising food and utility costs, and substantial increases in labor expenses tied to California’s minimum wage.

The business was ultimately sold to lenders for roughly forty million dollars, less than half of what it had sold for fourteen years earlier.

The transaction underscored how dramatically valuations had fallen in the sector.

For franchise owners, the financial strain has been immediate and personal.

One operator managing ten fast food locations estimated that the wage increase added nearly half a million dollars in annual labor costs.

Rodrik, who owns eighteen McDonald’s locations across the state, responded by raising prices between five and seven percent within three months.

He also delayed capital improvements such as equipment upgrades and facility maintenance.

When operators are forced to choose between paying higher wages and investing in infrastructure, the underlying business model begins to fracture.

In smaller communities, the effects have been even more visible.

A Fosters Freeze location in rural California closed permanently on the very day the wage increase took effect.

Employees initially believed the closure was a prank, only to learn hours later that the business was finished.

Management later explained that keeping the restaurant open under the new cost structure was no longer feasible.

Several workers expressed that they would have preferred lower wages to unemployment.

For those who remained employed, higher hourly pay often came with fewer hours.

Surveys conducted by policy institutes found that nearly ninety percent of fast food workers experienced reduced schedules following the wage hike.

More than one third lost supplemental benefits.

Workers who previously logged thirty five hours per week found themselves limited to twenty hours or less, reducing total income despite higher hourly rates.

In many locations, staffing levels were cut, increasing workloads and pressure on remaining employees.

Consumers have also felt the impact.

Restaurant prices in California rose more than fourteen percent between late 2023 and the end of 2024, nearly double the national average.

Major chains openly acknowledged that higher wages would be passed on to customers.

Chipotle raised prices by as much as seven percent in California within days of the law taking effect.

McDonald’s executives noted that customers earning less than forty five thousand dollars annually were cutting back on visits, finding it cheaper to eat at home.

Nationally, fast food prices have been rising for years, but California’s acceleration has been especially pronounced.

Menu prices at McDonald’s have doubled since 2014, with some items increasing even more sharply.

What was once the cornerstone of affordable dining is increasingly out of reach for lower income consumers.

Not all operators are failing.

Some large franchise groups with strong financial controls and economies of scale continue to operate successfully.

Owners managing dozens of locations have adapted by scrutinizing costs at an unprecedented level, down to portion sizes and condiment usage.

Survival now depends on relentless efficiency rather than growth.

The transformation underway does not signal the end of fast food in California, but it does mark a fundamental shift.

Workers who keep their jobs often earn more per hour but work fewer hours.

Customers pay higher prices for the same products.

Smaller operators and marginal locations disappear.

The industry becomes leaner, more automated, and more selective about where it operates.

As more closures occur and more workers adjust to reduced schedules, the broader implications become harder to ignore.

What began as a policy aimed at raising wages has reshaped an entire sector of the economy.

The long term effects will continue to unfold, influencing employment, consumer behavior, and the future structure of service work in America.

News

JRE: “Scientists Found a 2000 Year Old Letter from Jesus, Its Message Shocked Everyone”

There’s going to be a certain percentage of people right now that have their hackles up because someone might be…

If Only They Know Why The Baby Was Taken By The Mermaid

Long ago, in a peaceful region where land and water shaped the fate of all living beings, the village of…

If Only They Knew Why The Dog Kept Barking At The Coffin

Mingo was a quiet rural town known for its simple beauty and close community ties. Mud brick houses stood in…

What The COPS Found In Tupac’s Garage After His Death SHOCKED Everyone

Nearly three decades after the death of hip hop icon Tupac Shakur, investigators searching a residential property connected to the…

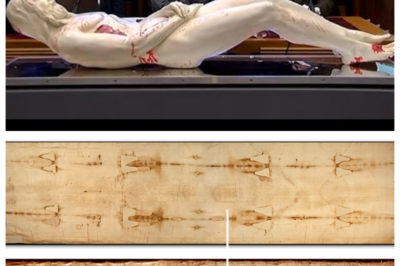

Shroud of Turin Used to Create 3D Copy of Jesus

In early 2018 a group of researchers in Rome presented a striking three dimensional carbon based replica that aimed to…

Is this the image of Jesus Christ? The Shroud of Turin brought to life

**The Shroud of Turin: Unveiling the Mystery at the Cathedral of Salamanca** For centuries, the Shroud of Turin has captivated…

End of content

No more pages to load