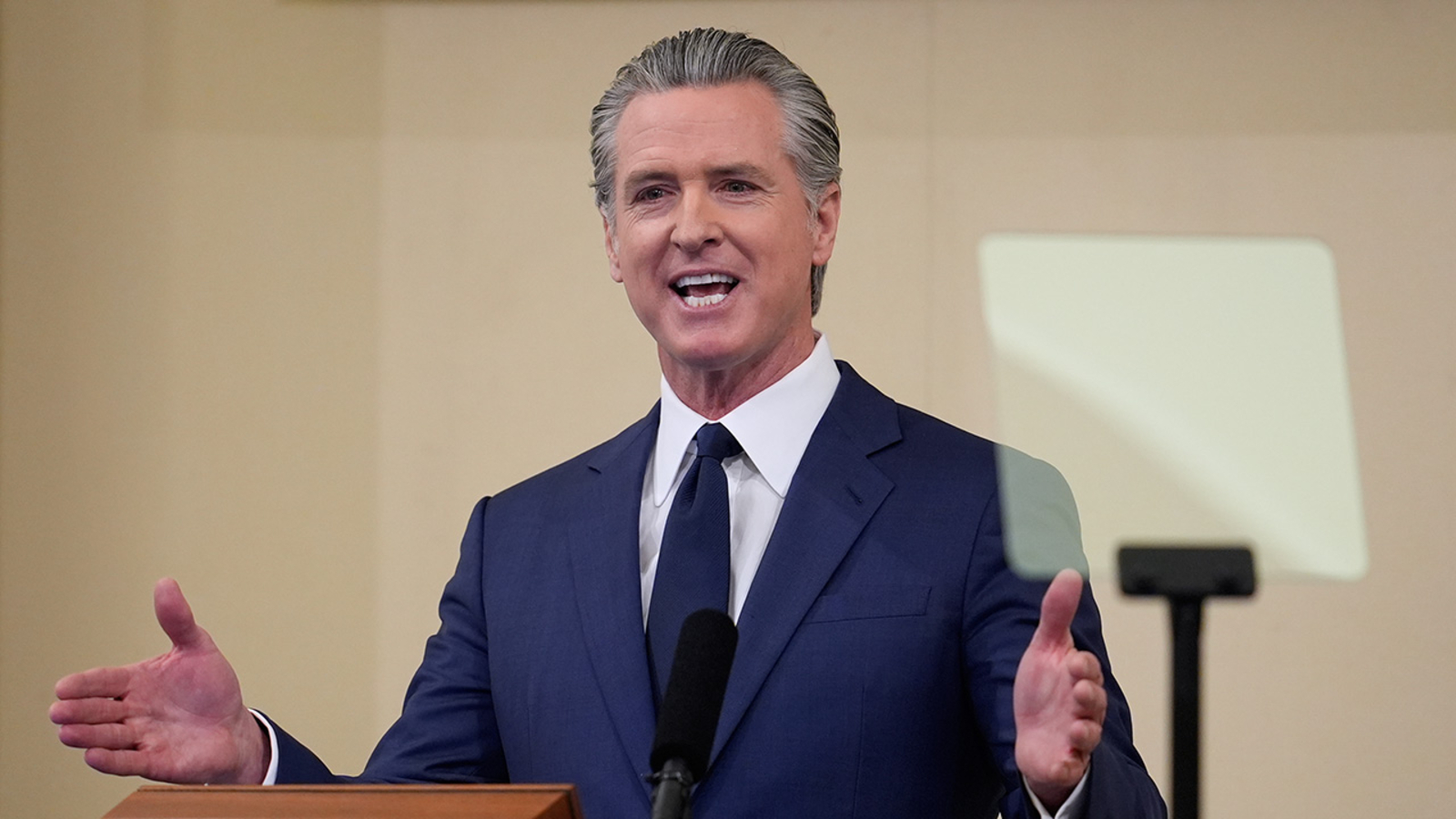

California’s Budget Crisis: Governor Faces Backlash After Court Blocks $4 Billion Revenue Plan

In a stunning legal blow, California’s governor saw a $4 billion budget repair plan evaporate overnight when a state appeals court invalidated the administration’s claim to retroactively collect corporate tax revenues.

This ruling not only dismantled the foundation of the state’s spending but also cast a harsh spotlight on decades of wishful accounting and political brinkmanship.

The crisis began with an attempt to reinterpret a decades-old tax provision known as the single sales factor formula—a method used to determine how much multi-state corporations owe California based on customer location.

For years, companies had relied on an older, more favorable interpretation that lowered their tax burden.

The governor’s finance team argued that the state had been too generous and sought to claw back billions by retroactively applying a stricter interpretation.

This legal gambit was not a new tax but a reinterpretation applied backward, a move that major corporations challenged in court.

Despite warnings, the administration proceeded to spend the projected revenue, promising increased funding for schools, infrastructure, and pensions.

Six days ago, the court ruled unanimously against the state, declaring the retroactive tax theory unconstitutional and emphasizing that companies had every right to rely on prior guidance.

The decision described the state’s approach as fiscal desperation and legal overreach, wiping $4 billion off the ledger with no backup plan.

The fallout is immediate and severe.

California’s credit rating faces downgrade risk, potentially increasing borrowing costs and jeopardizing future projects.

Midyear budget cuts loom, threatening promised school funding, road construction, and healthcare programs.

Local governments dependent on state funds are already preparing for painful service reductions or tax hikes, directly impacting families and communities.

For example, Maria’s after-school program in Fresno faces closure without state grants, leaving 80 children without care and parents scrambling.

Riverside County’s subsidized bus routes that connect vulnerable populations to essential services risk elimination, disrupting lives and livelihoods.

Political finger-pointing has begun.

Opponents accuse the governor of reckless gambling with phantom revenue to avoid tough budget decisions, while allies blame outdated tax laws and corporate loopholes.

Yet neither side offers a clear solution to the growing deficit.

The administration’s options are bleak: appeal the court ruling, negotiate a partial settlement, impose across-the-board cuts, or seek politically fraught tax increases.

None address California’s deeper structural problem—a budget model reliant on volatile revenue streams and growing expenses from healthcare, pensions, and wages.

This court decision did not cause the crisis but exposed the fragile fiscal reality beneath years of optimistic projections and one-time fixes.

As agencies freeze hiring and projects stall, the human cost mounts quietly in libraries, schools, fire stations, and hospitals.

California, the world’s fifth-largest economy, faces a systemic failure where political expediency trumps honest accounting.

The state’s inability to balance its ambitions with sustainable funding threatens to turn this ruling into the moment the budget “house of cards” began to collapse.

News

Miracle on Display: How an 85-Year-Old COGIC Mother’s Faith Conquered a Death Sentence!

The Miraculous Healing Testimony of an 85-Year-Old COGIC Church Mother That’s Captivating the World In a world often filled with…

Bishop Earl Carter’s Explosive Exposé: The Dark Secrets Behind COGIC’s Leadership Revealed!

Bishop Earl Carter’s Unfiltered Truth Bombs on COGIC and Church Leadership: What He Really Said In a passionate and unrestrained…

Exclusive: Inside the Emotional Passing of the Baton at Full Gospel Baptist Fellowship’s Worship Leadership!

A New Era in Worship Leadership: Pastor Warryn Campbell Takes the Helm at Full Gospel Baptist Fellowship In an inspiring…

Bishop Emeritus Charles Blake Sr.’s Battle: A Family’s Faith and Miracles Amidst Health Struggles!

Heartfelt Condolences and Strength for Bishop Emeritus Charles Blake Sr. and Family Bishop Emeritus Charles Blake Sr., a revered spiritual…

From Despair to Divine Praise: The Secret Struggle Behind Richard Smallwood’s Most Iconic Song

The Untold Story Behind Richard Smallwood’s “Total Praise”: Born in Darkness, Became a Gospel Anthem By the mid-1990s, gospel music…

How Richard Smallwood’s Gospel Mastery Shaped Black Culture and Inspired Icons Like Whitney Houston!

Richard Smallwood: A Gospel Legend’s Legacy Celebrated by Phylicia Rashad and Beyond Richard Smallwood’s death sent ripples far beyond the…

End of content

No more pages to load