A little-known clause in a Trump-era tax law is now unexpectedly targeting foreign tourists with IRS scrutiny and surprise tax notices based on extended stays, sparking confusion, fear, and backlash that could threaten America’s image as a welcoming travel destination.

Foreign tourists visiting the United States are facing a surprising financial bombshell linked to a little-known provision of a Trump-era tax law, triggering confusion, frustration, and even legal concerns at some of the nation’s most popular travel destinations.

The unexpected problem stems from a clause in the **Tax Cuts and Jobs Act of 2017**, passed under the Trump administration, that expanded the **“substantial presence test”** and IRS oversight of foreign individuals earning or spending in the U.S.

While originally intended to target wealthy international investors or business executives attempting to sidestep tax liabilities, recent enforcement has affected an unintended group: ordinary tourists.

Several international visitors have reported receiving notices from the **IRS** demanding clarification—or in some cases, unexpected payments—after brief trips to the U.S., including to places like **Orlando, Las Vegas, and New York City**.

At issue is how long they stayed, what they purchased, and in some cases, whether their expenses or temporary income were reported correctly.

A recent case in Florida involved a British family who spent three weeks vacationing in the U.S. in late 2024.

Months later, they were shocked to receive a letter stating they had exceeded the “183-day rule” over a rolling three-year window, prompting a review of their status for potential tax liability.

Though ultimately resolved without penalty, the family described the process as “unbelievably stressful.”

“I thought it was a scam at first,” the father said. “Why would the IRS care about tourists? We were here to visit Disney World, not do business.”

The situation, however, is more complex than it seems. Under the substantial presence test, anyone who spends significant time in the U.S. over several years—even if only visiting—is potentially flagged for review.

While enforcement had remained light in past years, new technology and data-sharing agreements have allowed the IRS to track travel patterns more closely.

**Hospitality experts and tourism officials** are warning that these measures could chill foreign travel to the U.S., especially from countries with strong middle-class travel culture like the U.K., Germany, Japan, and Australia.

“It’s already expensive to visit the U.S.,” one travel consultant noted. “Now add the fear of being taxed just for showing up, and you’ll see some second thoughts.”

**Trump administration officials** who originally supported the bill say the intent was never to target tourists, and critics now argue that the IRS’s widened net is a consequence of overly broad legislation being applied with increasing rigidity.

“The law was designed to close loopholes,” said one former Treasury advisor. “But like many things, it’s now catching people it wasn’t meant to catch.”

**Immigration lawyers and tax professionals** are now seeing a spike in consultations from foreign nationals unsure whether they might be subject to the rule.

Some fear the next step could involve visa complications or even restrictions on re-entry, especially if someone is deemed to have mistakenly misrepresented their travel purpose or duration.

Social media has also picked up on the story, with posts going viral from affected travelers sharing their experiences and warning others.

In one now-deleted Reddit thread, a Canadian couple described being detained for hours at the border after multiple short visits to family in the U.S. raised red flags with border agents and the IRS.

Meanwhile, travel industry advocates are urging the **Biden administration** to clarify how the rule is enforced or provide a carve-out for genuine tourism.

Some have even called for repeal or reform of the specific section of the law, arguing that it damages the country’s reputation as a welcoming destination.

So far, the **IRS** has issued no formal statement on the controversy, but internal sources say enforcement is likely to continue as part of broader tax compliance efforts.

For now, travelers are being advised to carefully document all visits, save receipts, and consult with legal experts if their time in the U.S. is approaching the 183-day threshold over any rolling three-year period.

While the original intention may have been to catch tax evaders and foreign money-laundering schemes, this unintended consequence of a sweeping law now threatens to entangle everyday travelers—and possibly discourage tourism just when the industry is trying to fully recover post-pandemic.

News

Denzel Washington Humiliates Ryan Reynolds and Blake Lively: A Hollywood Power Couple in Decline

Denzel Washington publicly criticized Ryan Reynolds during a promotional event, highlighting tensions and a rocky history between the actors. …

Bill Maher SLAMS Kimmel & Colbert for Going TOO FAR! Claims They Turned Late Night into CNN & MSNBC!

Bill Maher blasted Jimmy Kimmel and Stephen Colbert, accusing them of turning late-night comedy into partisan political talk shows. …

The Woke Girl Boss Era Crumbles: Rachel Zegler and Amandla Stenberg’s Careers in Decline

Once-celebrated rising stars, Rachel Zegler and Amandla Stenberg now face mounting backlash, with their outspoken comments and controversial roles fueling…

At Age 60, Martin Lawrence Names The 5 Celebrities He HATES The Most!

At 60, comedy legend Martin Lawrence shocked fans by naming five celebrities he “hates the most,” reopening old wounds and…

LeBron James Calls Out Kawhi Leonard Over $28 Million Fraud Scandal: A Tense Confrontation That Could Change the NBA Forever

LeBron James reportedly confronted Kawhi Leonard over allegations of a $28 million fraudulent endorsement deal linked to Clippers owner Steve…

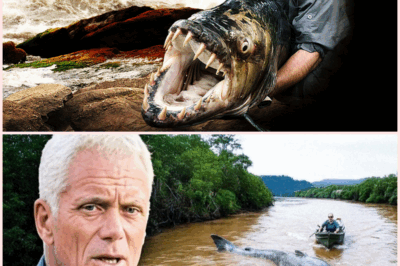

At 69, Jeremy Wade Breaks Silence on the Cancellation of River Monsters: A Journey Through Legends and Mysteries

At 69, Jeremy Wade has opened up about the bittersweet cancellation of River Monsters, reflecting on how the show shaped…

End of content

No more pages to load