The Hidden Abyss: A Tale of Trust and Betrayal in Finance

In the heart of a bustling city, where skyscrapers scraped the sky and dreams were born and buried in the shadows of ambition, there lived a man named David Carter.

He was an ordinary man with an extraordinary thirst for knowledge, particularly about the world of finance.

David had always been fascinated by the intricate dance of money, how it flowed through the veins of society, nourishing dreams and ambitions, yet also suffocating them in a vice of debt and despair.

One fateful evening, as the sun dipped below the horizon, casting a golden hue over the city, David stumbled upon a video that would change his life forever.

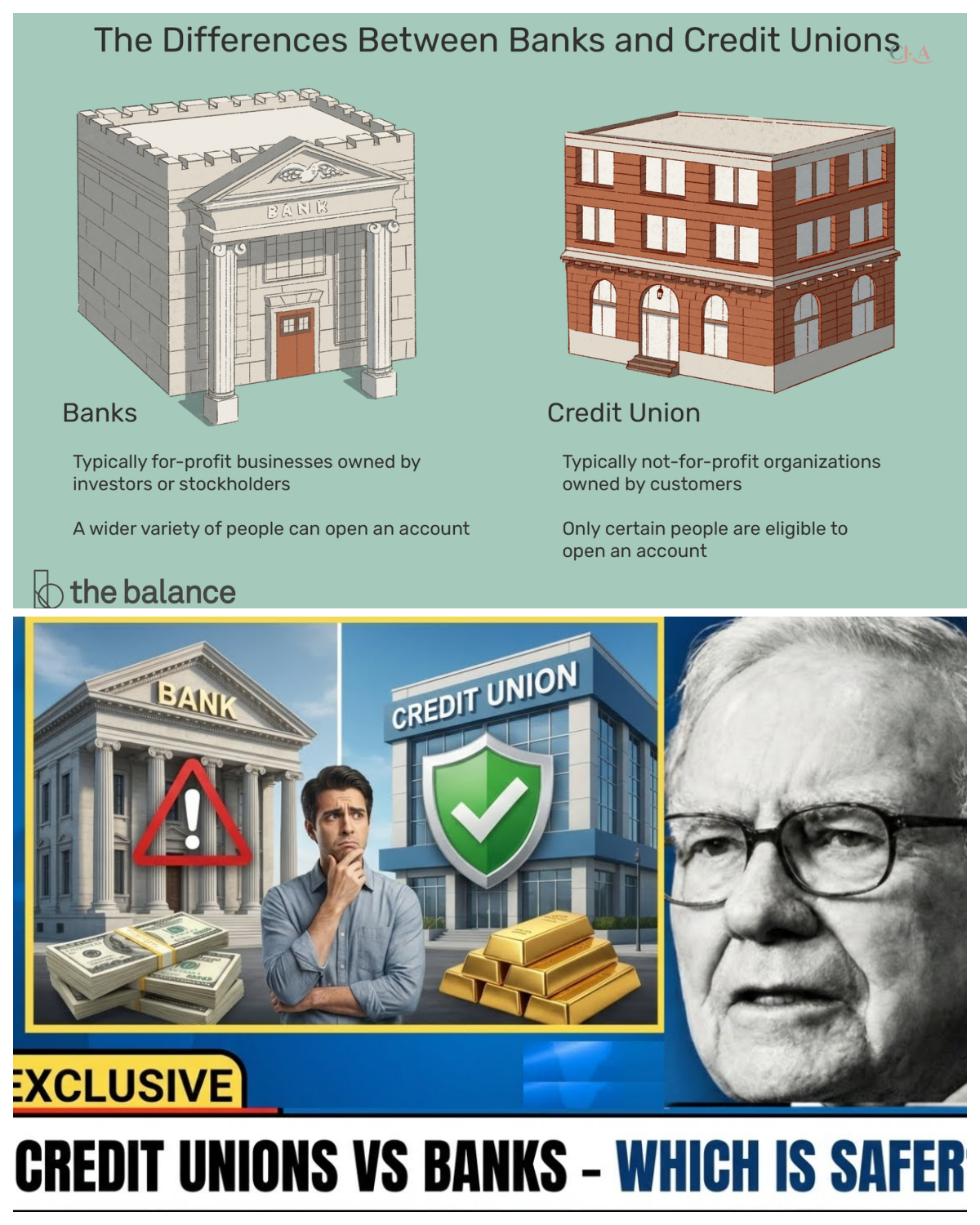

It was titled “Credit Unions vs Banks: Which Is Actually Safer Right Now?” The host, a charismatic figure named Michael Reed, spoke with a fervor that ignited a fire within David.

He revealed shocking truths about the American banking system, secrets that were hidden behind layers of bureaucracy and red tape.

As David watched, his heart raced.

The revelations about the secret downgrades by the OCC and the FDIC watchlists naming banks on the brink of failure sent chills down his spine.

He had always trusted banks, believing they were the guardians of his hard-earned money.

But now, he was faced with a haunting question: Were credit unions safer? Should he risk everything and move his savings?

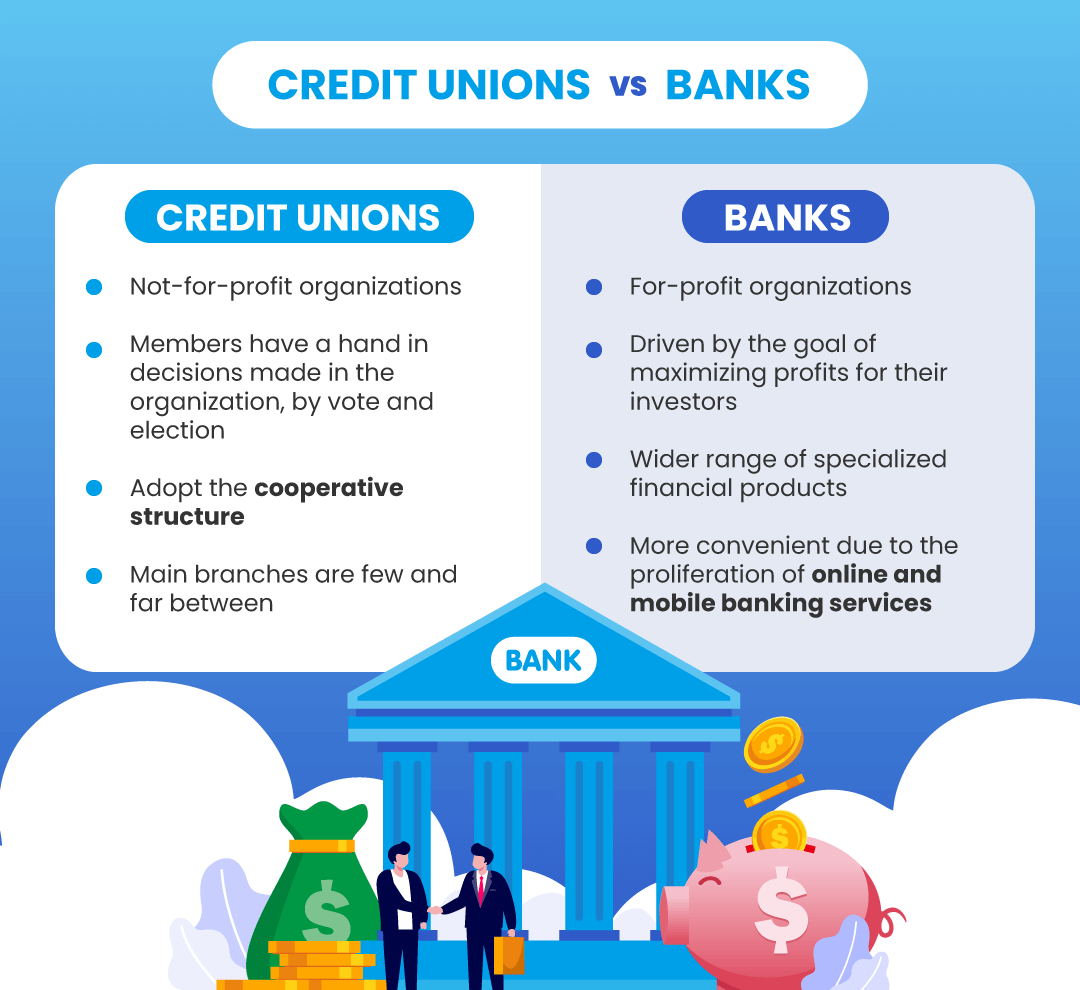

The allure of credit unions was strong.

They promised community, lower fees, and a sense of belonging.

:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

But Michael painted a different picture.

He spoke of rising auto loan delinquencies and the alarming increase in problem-rated credit unions.

David’s mind raced as he processed this information.

Could he really trust these institutions?

Driven by a mix of fear and curiosity, David decided to investigate further.

He spent sleepless nights poring over financial reports, analyzing balance sheets, and reaching out to friends who worked in the banking sector.

With each piece of information he uncovered, the world of finance began to resemble a dark labyrinth filled with hidden dangers.

One day, while sipping coffee in a dimly lit café, David met Sarah, a financial analyst with a piercing gaze and an air of confidence.

She had heard of his quest for knowledge and offered to help him navigate the murky waters of banking and credit unions.

Together, they delved deep into the financial abyss, uncovering truths that would leave most people trembling in fear.

As they explored, David learned about the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA).

Both promised protection for deposits, but Sarah explained the critical differences in how each responded during crises.

The government’s actions during the 2008 financial collapse loomed large in their discussions, a specter that haunted every decision they made.

Their investigation led them to a small credit union in the heart of the city, a place that had once been a beacon of hope for many.

As they entered, the atmosphere felt heavy, almost suffocating.

The tellers wore forced smiles, but David could see the anxiety behind their eyes.

He approached the manager, Mr.Thompson, a weary man with a haunted look, and asked about the challenges the credit union faced.

Mr.Thompson hesitated, glancing around as if the walls had ears.

Finally, he spoke in a hushed tone, revealing the truth that lay beneath the surface.

Deposits were fleeing, members were panicking, and the once-thriving institution was on the brink of collapse.

David’s heart sank.

This was not the safe haven he had imagined.

Days turned into weeks, and the weight of their findings pressed heavily on David and Sarah.

They compiled their research, creating a presentation that would expose the hidden risks of both banks and credit unions.

Their goal was to inform the public, to shine a light on the dark corners of the financial system that had been shrouded in secrecy for far too long.

But as they prepared to unveil their findings, they received a chilling warning.

An anonymous message warned them to stop their investigation.

It was signed simply, “The Keepers of the Status Quo.

” Fear gripped David.

Who were these people? What lengths would they go to protect their interests?

Ignoring the threat, David and Sarah pressed on.

They organized a community meeting, inviting residents to hear their findings.

The room was packed, tension crackling in the air.

As David presented, he could see the disbelief and fear in the eyes of the audience.

He revealed the hidden risks, the alarming statistics, and the reality that both banks and credit unions were facing crises of their own.

Just as he finished, a figure emerged from the shadows.

It was Michael Reed, the charismatic host of the video that had ignited David’s journey.

But now, he was no longer the beacon of truth.

He was a puppet master, pulling strings behind the scenes, a man with ties to powerful banking interests.

Michael confronted David, accusing him of spreading fear and misinformation.

The tension in the room escalated, and a heated exchange ensued.

David’s heart raced as he realized the stakes were higher than he had ever imagined.

This was not just about money; it was about control.

In a shocking twist, David revealed a secret he had uncovered during his investigation.

He had discovered financial ties between Michael and several major banks, connections that explained his sudden interest in discrediting their findings.

The audience gasped as the truth unfolded, and Michael’s facade began to crumble.

As the confrontation reached its climax, David stood tall, empowered by the knowledge he had gained.

He challenged Michael to reveal the truth about the banking system, to come clean about the risks that lay hidden beneath the surface.

The room erupted in applause as David called for transparency and accountability.

In the aftermath, David and Sarah became local heroes, advocates for financial literacy and consumer rights.

Their story spread like wildfire, igniting a movement for change in the financial industry.

People began to question their institutions, demanding answers and accountability.

But as David looked out over the city from his apartment, he knew the battle was far from over.

The Keepers of the Status Quo would not go down without a fight.

He felt a chill run down his spine as he realized that the world of finance was a complex web, filled with shadows and secrets.

In the end, David learned that trust is a fragile thing, easily shattered by greed and deception.

He vowed to continue the fight, to expose the truth, and to empower others to take control of their financial futures.

The hidden abyss of the banking system had been revealed, but the journey was just beginning.

News

✋ SHOCK AT THE VATICAN — POPE LEO XIV REFUSES JONATHAN ROUMIE’S HANDSHAKE IN THEIR FIRST FACE-TO-FACE, LEAVING THE ROOM FROZEN IN SILENCE 😳 The narrator whispers with razor-edged suspense as cameras flash, smiles falter, and one small gesture turns into a thunderclap of awkward tension, aides glancing at each other like they’ve just witnessed a diplomatic disaster unfolding in real time 👇

The Unforgiven Moment: When Faith Meets Rejection In the heart of Vatican City, beneath the grand arches and the watchful…

🧀 DAIRY DYNASTY DEFECTS — CALIFORNIA GOVERNOR SCRAMBLES AS LEPRINO FOODS OFFICIALLY PACKS UP AND WALKS AWAY, LEAVING A BILLION-DOLLAR HOLE 🏭 The narrator bites hard as forklifts roll through half-empty warehouses and executives slip out back doors with sealed folders, whispering that when the cheese king quietly exits, it’s not just business — it’s a warning flare that Sacramento may have pushed one giant too far 👇

The Collapse of a Dairy Empire In the heart of California, Michael stood at the edge of the sprawling Leprino…

🚛 HIGHWAY SIEGE — TRUCKERS’ REVOLT CHOKES EVERY LAND ROUTE AS KHAMENEI FACES THE BIGGEST PRESSURE OF HIS RULE ⚡ The narrator growls over sweeping shots of endless rigs parked bumper-to-bumper like a steel wall, engines silent but defiance roaring, while officials pace marble halls realizing the nation’s lifelines have been cut by ordinary drivers who suddenly hold extraordinary power 👇

The Collapse of Silence: A Nation on the Edge In the heart of Iran, where the sun beats down relentlessly…

⛽ REFINERY ROULETTE — CALIFORNIA GOVERNOR CORNERED AS PHILLIPS 66 STARTS CLOSURE, SPARKING AN ENERGY PANIC ACROSS THE STATE 🚨 The narrator’s voice cuts sharp as sirens and smokestacks fade into silence, aides shuffle frantic memos, and drivers stare at price boards climbing like thermometers in a heatwave, turning a corporate decision into a political nightmare no one in Sacramento can outrun 👇

The Last Drop of Hope In the heart of California, the sun set like a dying ember, casting shadows over…

⛽ GASOLINE MELTDOWN — CALIFORNIA GOVERNOR IN HOT WATER AS REFINERY SHUTDOWNS SPARK A PRICE SHOCK THAT HITS LIKE A PUNCH 🚨 The narrator growls over footage of darkened stacks and mile-long lines at pumps, hinting at late-night calls, nervous aides, and a leadership scramble as drivers stare at spinning numbers, wondering how a routine shutdown turned into a full-blown political inferno 👇

The Gasoline Conspiracy: California’s Fuel Crisis Unveiled In the heart of California, where the sun kissed the golden hills and…

🍔 GOLDEN STATE SHOCKER — CALIFORNIA GOVERNOR IN FULL-BLOWN CRISIS AFTER IN-N-OUT’S SECRET EXIT PLAN LEAKS, INSIDERS WHISER “THEY’RE PACKING UP” 🚨 The narrator sneers as late-night boardroom memos surface, fryers go cold, and stunned employees watch rumors spread like wildfire, turning a beloved burger chain into the unlikely spark of a political meltdown that has Sacramento sweating bullets 👇

The Hidden Collapse: A Hollywood Tale of California’s Economic Crisis In-N-Out Burger had always been a symbol of California’s vibrant…

End of content

No more pages to load