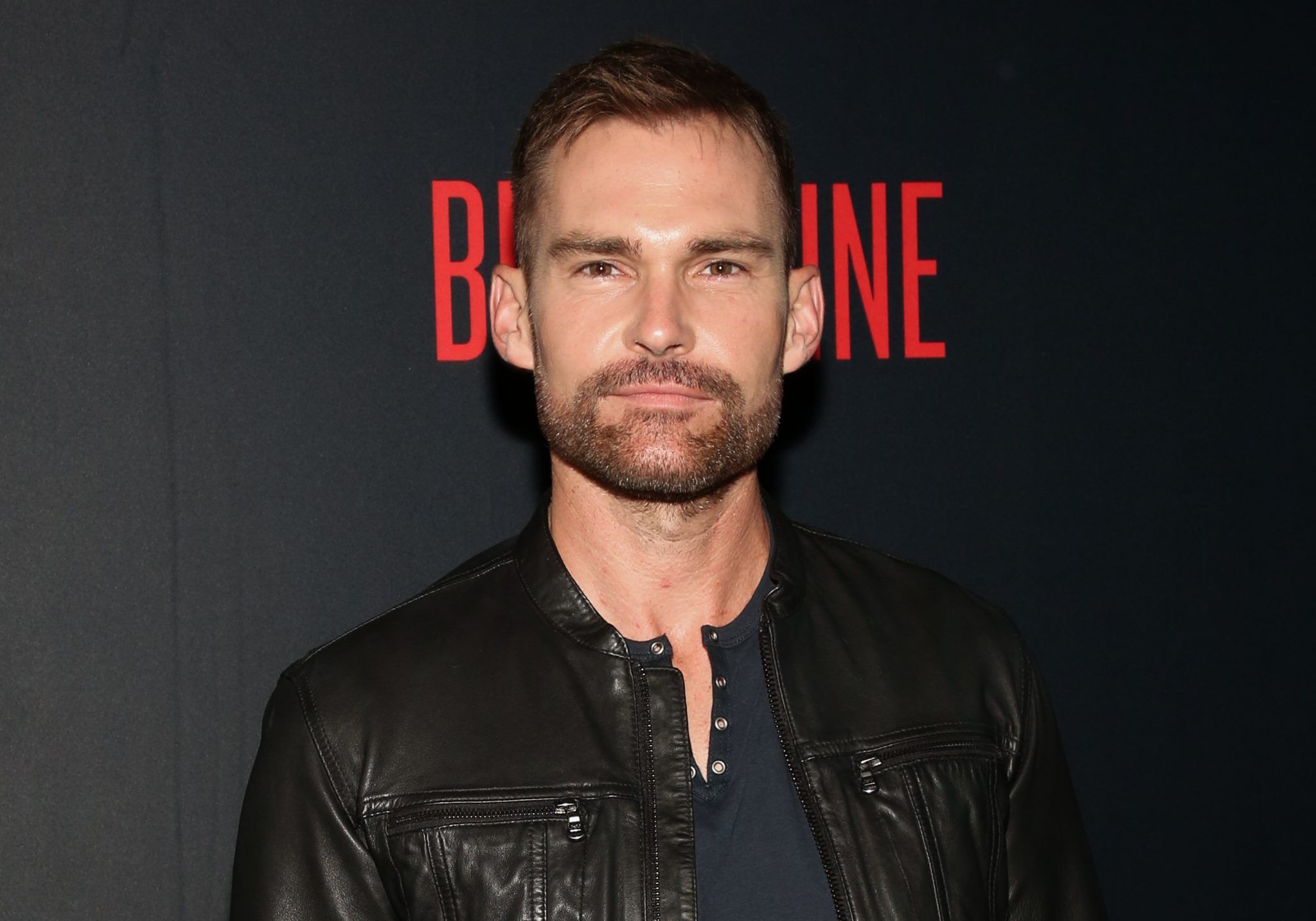

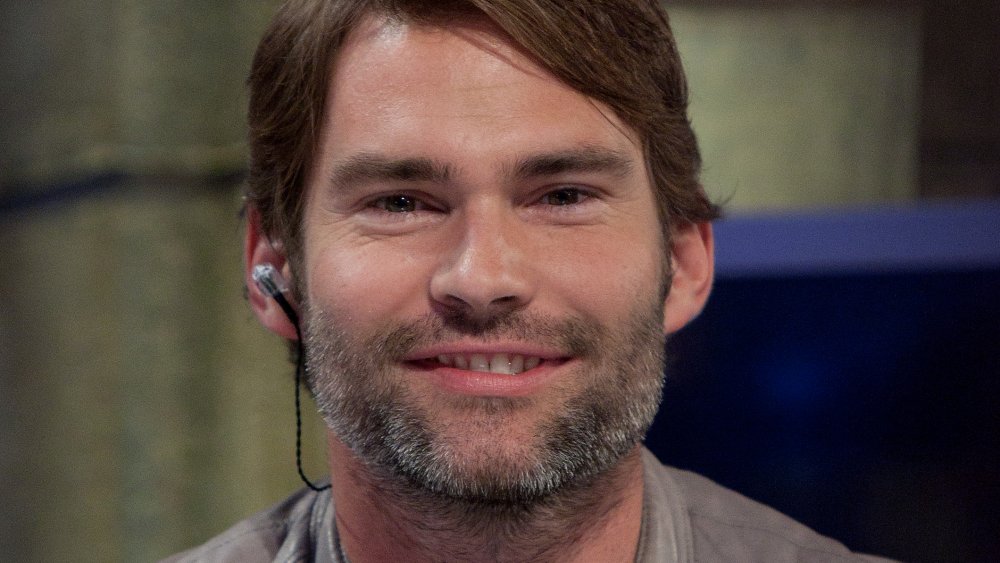

Seann William Scott’s Financial Success Beyond Hollywood

Seann William Scott, the actor best known for his breakout role as Steve Stifler in the American Pie franchise, has made a name for himself not only in the world of entertainment but also in the realm of smart investing.

While his on-screen career provided him with fame and fortune, Scott’s savvy approach to managing his finances has helped him build a diverse and impressive portfolio that ensures financial security even during the unpredictable nature of Hollywood’s career landscape.

Though he is widely recognized for his comedic roles, Scott’s wealth and investments reflect a side of him that is less publicized but equally important in the story of his financial success.

Over the years, he has built up a net worth that includes substantial holdings in real estate, dividend stocks, cash savings, and liquid assets.

As of recent estimates, Scott is worth an impressive amount—partially due to his strategic investments and financial discipline.

His portfolio consists of $12 million in dividend stocks alone, which generate a consistent $31,000 per month in income.

This steady stream of passive earnings serves as an example of how an actor can diversify his wealth and continue to earn even after his primary career source might slow down.

In addition to his investment in stocks, Scott also holds an $18 million real estate portfolio that is free of debt.

Real estate has long been one of the most reliable investment options for wealthy individuals, and Scott’s decision to purchase income-producing properties and hold them debt-free has provided him with a stable foundation for his wealth.

This real estate portfolio not only offers him a strong financial backing but also ensures that he can weather any future career disruptions.

Despite the cancellation of his recent show Welcome to Flatch, which had been a significant source of income for him in recent years, Scott’s financial situation remains solid.

The show’s cancellation in 2024 was a setback for the actor, who had been relying on it as a consistent paycheck.

However, this loss of income has not derailed his financial stability.

Scott continues to earn royalties from previous work, including the American Pie films, which still generate significant revenue from streaming services, DVD sales, and syndication.

These royalties are a direct result of the long-term value of his earlier projects, and they play a pivotal role in sustaining his income, even when his acting career slows down.

In addition to royalties, Scott’s investment portfolio, which includes a mix of stocks, bonds, and other financial instruments, allows him to maintain a diversified income stream.

His ability to earn through investments rather than relying solely on acting jobs has afforded him a level of financial freedom that many in the entertainment industry cannot claim.

With $172,485 in cash and an additional $11.

9 million in easily liquidated assets, Scott’s wealth is both secure and flexible.

This means he can tap into his assets if necessary without having to worry about a market crash or an unexpected financial emergency.

What makes Scott’s financial approach so remarkable is not just his ability to amass wealth but his clear understanding of the importance of diversification.

While many actors and entertainers rely heavily on a few income sources—such as acting salaries or endorsement deals—Scott’s strategy of building a portfolio that includes real estate, stocks, and liquid assets gives him security that extends beyond the volatility of Hollywood.

His financial discipline showcases the benefits of planning ahead and managing wealth wisely, even when one’s primary career path may take an unexpected turn.

Scott’s story is a testament to the importance of preparing for life after the spotlight.

Many actors face a challenging transition when their careers start to slow down, often struggling to maintain their previous levels of income.

However, Scott’s proactive approach to his finances ensures that he does not face this dilemma.

Instead of relying solely on acting roles to support his lifestyle, he has used his wealth to create passive income streams that continue to support him, regardless of the success or failure of his acting projects.

Beyond the numbers and investments, Scott’s life is also supported by a loving family.

He has frequently spoken about his close-knit family and the importance of having a supportive network, which he credits for helping him navigate both the highs and lows of his career.

Scott has also expressed his gratitude for his relationship with his “hot mom,” who has been a source of support throughout his journey.

While the public might only see him on screen or hear about his financial success, it is clear that Scott’s personal life is an equally significant aspect of his overall well-being.

The actor’s financial story serves as a powerful reminder of the importance of long-term planning and diversification.

In an industry where success can be fleeting and opportunities can dry up unexpectedly, Scott has built a foundation that not only ensures his current lifestyle but also secures his future.

His approach offers valuable lessons for anyone looking to build lasting wealth—whether in Hollywood or outside of it.

By focusing on more than just his acting career, Scott has found a way to continue thriving financially.

His investments in real estate, stocks, and other assets ensure that he has a consistent income stream that doesn’t depend solely on the success of his latest project.

In a world where career stability can often be elusive, Scott’s financial portfolio provides him with a level of security that many can only dream of achieving.

Seann William Scott’s financial success shows that with careful planning, diversification, and a focus on long-term goals, anyone—no matter their profession—can build a lasting legacy of wealth.

His ability to adapt and thrive in the face of career changes reflects not only his business acumen but also his understanding of what it takes to truly secure one’s financial future.

News

“Elon Musk Takes Caitlin Clark

BREAKING NEWS: Elon Musk Backs Caitlin Clark with $10 Million in Funding: “I Support You, Caitlin Clark” In an unexpected…

“Tesla’s Struggles Deepen

Tesla’s Sales Plunge 45% in January 2025, Pressuring Stock Amid Global Struggles In a shocking development for the electric vehicle…

Elon Musk’s Bold $112 Million

Elon Musk Donates $112 Million in Tesla Stock to Help the Homeless. Elon Musk Explains Why… In an unexpected and…

“Taylor Swift’s Heartfelt Encounter

Taylor Swift Hears a Homeless Man Playing Guitar – What Happened Next Will Leave You in Tears It was an…

“Elon Musk’s Shocking $900 Million

Elon Musk buys “The View” for $900 million to shut it down and remove Whoopi Goldberg In a surprising turn…

“Brittney Griner and Whoopi Goldberg

Brittney Griner and Whoopi Goldberg’s Bold Plan to Leave the United States Together In a surprising and thought-provoking revelation, basketball…

End of content

No more pages to load