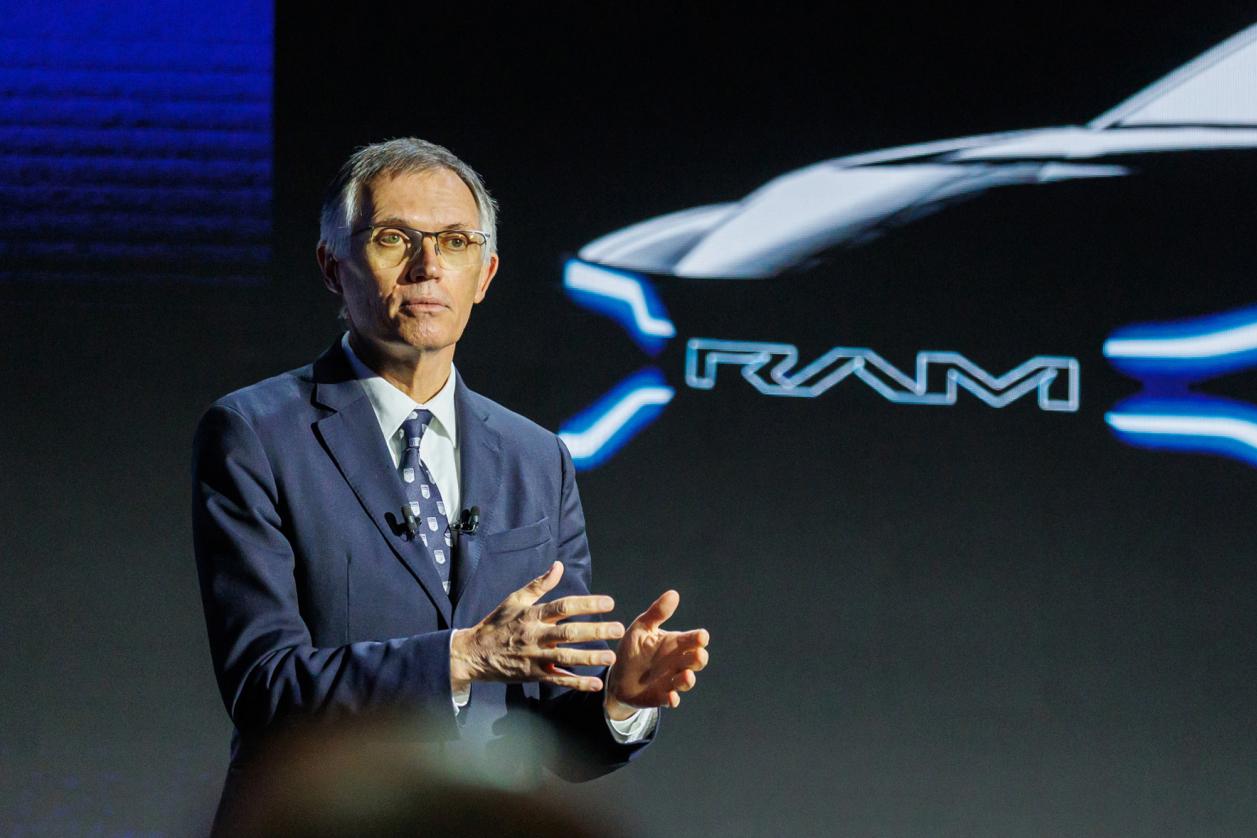

Stellantis Faces Crisis: Major Layoffs and a Shocking Shift in Strategy for Dodge, Jeep, Ram, and Chrysler

In a startling turn of events, Stellantis, the parent company of iconic automotive brands such as Dodge, Jeep, Ram, and Chrysler, has announced significant layoffs and a dramatic shift in its operational strategy.

The automotive giant is grappling with a staggering decline in sales, prompting concerns about the future viability of its brands.

This crisis is not just a result of internal mismanagement but reflects broader trends affecting the entire automotive industry.

As the company struggles to adapt to changing consumer preferences and market dynamics, the implications for its workforce and loyal customers are profound.

A Decline in Sales

Stellantis is facing a severe downturn, with global earnings plummeting by nearly 48% in the first half of the year.

Sales for its key brands have dropped dramatically over the last five years, with Dodge, Jeep, and Chrysler experiencing an alarming 39% overall decline.

Dodge has been particularly hard hit, with sales nosediving by an astonishing 67% since their peak in 2013.

Jeep isn’t faring much better, with a 44% decrease in sales since 2018, reaching the lowest sales figures in over a decade.

These figures paint a grim picture for the company as it attempts to navigate a rapidly changing automotive landscape.

Inventory Issues

One of the most pressing challenges Stellantis faces is a massive inventory backlog.

As of March 2024, the company reported a staggering 1.4 million unsold vehicles sitting in inventory.

This excess inventory is a direct result of production adjustments made during the pandemic, where the company initially ramped up production to compensate for supply chain constraints.

However, as consumer demand shifted, Stellantis found itself with too many vehicles that are now difficult to sell.

Many of these vehicles are aging models that do not resonate with today’s consumers, particularly in competitive segments like midsize SUVs.

Dealer Frustration

The Stellantis National Dealer Council has been vocal about its discontent with CEO Carlos Tavares’ short-term decision-making strategies.

Dealers argue that his focus on quick financial gains has come at the expense of long-term growth and brand value.

In a letter dated September 10, 2024, the council expressed serious concerns that Tavares’ strategies could lead to disaster, emphasizing that dealers feel increasingly isolated as they tackle these mounting challenges without adequate support from the manufacturer.

Recent cuts to marketing budgets and adjustments to dealer compensation policies have only exacerbated the situation, leaving many dealers struggling to maintain profitability amidst rising costs and unsold inventory.

Layoffs and Plant Closures

In light of these challenges, Stellantis has made the difficult decision to implement layoffs and close several plants.

The company’s cost-cutting measures, aimed at improving profits, have backfired, causing significant unrest among employees and dealers alike.

With many dealers burdened by unsold vehicles, the financial strain is palpable, leading to calls for increased support and better incentive programs to help clear the excess inventory.

Shifting Engine Strategies

Another significant challenge for Stellantis is the controversial shift away from traditional engines.

The introduction of the new hurricane twin-turbo inline six engine aims to replace the beloved V8 engines in several models.

While this change is designed to enhance fuel efficiency and lower emissions, it has drawn criticism from both dealers and consumers.

Longtime fans of Dodge and Ram are skeptical about the performance of these new engines, fearing that they may not deliver the same power and driving experience that they have come to expect.

Competitive Market Pressures

Stellantis is also facing fierce competition from other automakers that are adapting more quickly to market demands.

While competitors ramp up their discounts and financing deals to boost sales, Stellantis has maintained limited promotional efforts, putting its dealers at a disadvantage.

The pressure on dealers is mounting as they grapple with unsellable inventory and rising costs, threatening their financial stability.

Without significant changes to Stellantis’ incentive offerings, dealers worry that unsold vehicles will continue to accumulate, further impacting their profitability.

Rising Prices and Consumer Hesitance

As Stellantis grapples with declining sales, the company has opted to raise vehicle prices in an effort to maintain profit margins.

However, this strategy may be backfiring.

Higher prices are deterring potential buyers, especially in a market where consumers are tightening their wallets due to rising interest rates and economic uncertainty.

With sales figures sliding, particularly for Jeep and Ram, the decision to increase prices could further alienate buyers who are already hesitant to spend on new vehicles.

The Future of Chrysler

Chrysler, in particular, is facing a precarious future with a limited vehicle lineup consisting of just two models—the Chrysler 300 sedan and the Pacifica minivan.

This lack of diversity poses a significant disadvantage against competitors offering a broader range of vehicles.

As consumer preferences shift towards SUVs and crossovers, Chrysler’s traditional offerings are struggling to remain relevant.

Moreover, high prices compared to competitors are making it difficult for Chrysler to attract budget-conscious consumers.

Ram’s Dilemma

Ram trucks are also facing challenges as the company discontinues popular models, leaving consumers with fewer budget-friendly options.

The discontinuation of the Ram 1500 Classic has raised the starting price for the base Ram 1500, effectively eliminating an entry-level option for many buyers.

With rising prices and fewer affordable alternatives, potential buyers are increasingly looking at competitor brands that offer better value.

Jeep’s Competitive Edge at Risk

Jeep is not immune to these challenges either.

The rising prices of new Jeep Wranglers, coupled with a growing availability of used models, are putting Jeep’s competitive edge at risk.

As new models soar in price, savvy consumers are turning to the used market for more cost-effective alternatives.

If Jeep cannot address affordability concerns, it risks losing market share to competitors that offer similar vehicles at more attractive price points.

Dodge’s Struggles

Dodge is grappling with excessive inventory, particularly with the underperforming Dodge Hornet, which has become one of the least popular vehicles on the market.

With a significant supply of unsold Hornets sitting on dealer lots, the financial burden on dealers is growing.

As Dodge moves towards electrification, loyal customers are left feeling uneasy about the future of their beloved muscle cars.

The shift away from traditional models without adequate replacements has led to declining sales and dissatisfaction among dealers.

Conclusion: A Call for Change

The situation at Stellantis is dire, with major layoffs and a shocking shift in strategy affecting its core brands.

As the company grapples with declining sales, rising prices, and mounting dealer frustration, the future of Dodge, Jeep, Ram, and Chrysler hangs in the balance.

Without significant changes to its operational strategies and a renewed focus on consumer preferences, Stellantis risks losing its foothold in the competitive automotive market.

The coming months will be critical for the company as it navigates these challenges and seeks to regain the trust of its dealers and customers alike.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

News

🔥‘Are You Schmeichel in Disguise?’: The Chant That Made Old Trafford Erupt for Senne Lammens! – HTT

‘Are You Schmeichel in Disguise?’: The Chant That Made Old Trafford Erupt for Senne Lammens! Last night at Old Trafford,…

‘You Can Break LeBron, But Jordan? Never.’ – John Starks Spills the Truth About the GOAT Debate – HTT

‘You Can Break LeBron, But Jordan? Never.’ – John Starks Spills the Truth About the GOAT Debate There are debates…

Entire Catholic School Vanished in 1958 – 50 Years Later, a Hidden Room Shocked Investigators… – HTT

Entire Catholic School Vanished in 1958 – 50 Years Later, a Hidden Room Shocked Investigators… In 1958, St. Bartholomew’s Catholic…

Paul Newman’s Voice Returns From the Dead to Honor Robert Redford – A Tribute No One Saw Coming! – HTT

Paul Newman’s Voice Returns From the Dead to Honor Robert Redford – A Tribute No One Saw Coming! On September…

Nicole Kidman FINALLY Reveals Why She Divorced Keith Urban: “I Can’t Pretend Anymore” – HTT

Nicole Kidman FINALLY Reveals Why She Divorced Keith Urban: “I Can’t Pretend Anymore” Nicole Kidman and Keith Urban, once considered…

From Wedding Bells to Baby Steps: Alex Drummond’s Latest Update Will Melt Your Heart – HTT

From Wedding Bells to Baby Steps: Alex Drummond’s Latest Update Will Melt Your Heart There’s something undeniably touching about witnessing…

End of content

No more pages to load